As the tech industry gears up for its earnings season, investors and analysts alike are focused on the potential impacts of ongoing trade tensions and tariffs. Major companies such as Tesla (NASDAQ:TSLA), Apple (NASDAQ:AAPL), Alphabet (NASDAQ:GOOGL), Meta (NASDAQ:META), Microsoft (NASDAQ:MSFT), Amazon (NASDAQ:AMZN), and Nvidia (NASDAQ:NVDA) are set to report their quarterly earnings. These reports are highly anticipated as they could provide insights into how these companies are navigating the current economic landscape.

The tech sector has been under scrutiny due to the tariffs imposed by the Trump administration, which have affected supply chains and increased costs for many companies. Tesla, for example, has faced challenges with its supply chain, particularly with components sourced from China. The company is expected to address these issues in its upcoming earnings call, providing updates on how it plans to mitigate these impacts.

Apple, a key player in the tech industry, has also been impacted by tariffs. The company has a significant portion of its manufacturing operations in China, and any disruptions or additional costs could affect its bottom line. Investors will be keen to hear how Apple plans to manage these challenges and what strategies are in place to ensure continued growth.

Alphabet, the parent company of Google, is expected to provide insights into its advertising revenue, which has been a major driver of its financial performance. The company has faced increased competition from other digital advertising platforms, and its ability to maintain or grow its market share will be closely watched by analysts.

Meta, formerly known as Facebook, continues to focus on expanding its presence in the metaverse. As the company invests heavily in virtual and augmented reality technologies, its financial results will reflect the costs and potential returns of these ventures. Investors will be interested in any updates regarding user engagement and monetization of these new platforms.

Microsoft, known for its strong position in cloud computing, is expected to report robust earnings. The company’s Azure platform has been a significant growth area, and its performance in the cloud market will be a focal point for its earnings report. Additionally, Microsoft’s strategic acquisitions and partnerships will likely be addressed, providing insights into its growth strategy.

Amazon, a leader in e-commerce and cloud services, is anticipated to discuss its expansion plans and how it is dealing with increased competition in both sectors. The company’s AWS division remains a critical component of its business, and its earnings report will shed light on its performance and future prospects.

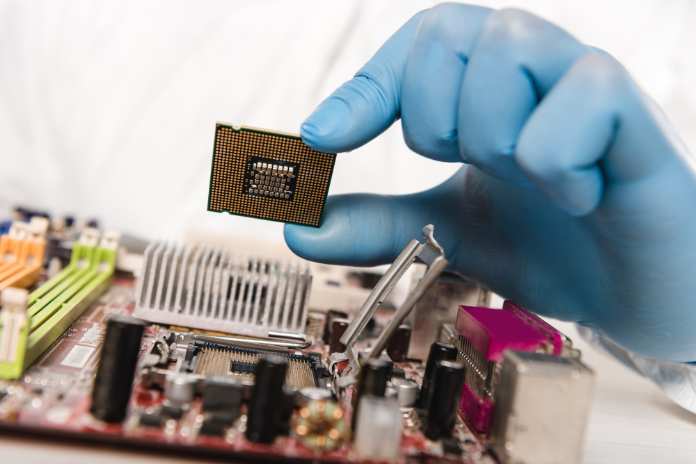

Nvidia, a key player in the semiconductor industry, has seen demand for its products surge due to advancements in AI and gaming. The company’s ability to capitalize on these trends and address supply chain constraints will be crucial for its continued success. Investors will be eager to learn about any new product launches and strategic initiatives aimed at maintaining its competitive edge.

Footnotes:

- Tesla has faced supply chain challenges due to tariffs. Source.

- Apple’s manufacturing operations in China are impacted by tariffs. Source.

- Meta is investing heavily in virtual and augmented reality technologies. Source.

Featured Image: DepositPhotos @ AllaSerebrina