In a significant market move, Teradyne (NASDAQ:TER) saw its stock plummet as the company announced potential impacts from newly proposed tariffs. As investors reacted to the news, the broader market experienced fluctuations, highlighting the ongoing sensitivity to international trade dynamics. Teradyne, known for its advanced automation equipment used in testing semiconductor products, is particularly vulnerable to changes in trade policies due to its extensive global supply chain.

The company’s recent statement indicated that the tariffs could affect its cost structure, potentially leading to higher prices for its products. This announcement comes at a time when the technology sector is already grappling with supply chain disruptions and increased competition. As a result, investors are keenly watching how these factors will play out in the coming quarters.

On the broader market front, the S&P 500 showed mixed results as companies across various sectors reported earnings. While some firms managed to beat expectations, others, like Teradyne, warned of potential headwinds. Analysts noted that this earnings season is crucial for assessing the resilience of companies amid economic uncertainties.

Technology stocks, in particular, have been under pressure as investors weigh the potential impacts of geopolitical tensions and regulatory changes. The sector’s volatility is partly driven by its reliance on international markets for both production and sales. Teradyne’s announcement serves as a reminder of the delicate balance companies must maintain in navigating these complex global dynamics.

Investors are advised to monitor developments in trade negotiations closely, as any progress or setbacks could significantly influence market sentiments. Additionally, companies like Teradyne that have a high exposure to international trade are expected to adjust their strategies to mitigate potential risks associated with tariffs and other trade barriers.

The market’s reaction to Teradyne’s announcement underscores the broader concerns about the impact of tariffs on corporate earnings and economic growth. As companies continue to adapt to a rapidly changing global landscape, investors will need to remain vigilant and informed to navigate the challenges ahead.

Moving forward, it will be essential to keep an eye on how Teradyne and similar companies adjust their operations to counteract any negative effects of tariffs. Strategies may include diversifying supply chains, seeking alternative markets, or investing in technology to reduce reliance on affected regions. These measures could prove pivotal in maintaining competitiveness and ensuring long-term growth amid an unpredictable economic environment.

Footnotes:

- Teradyne’s announcement about tariff impacts was reported in their latest earnings call. Source.

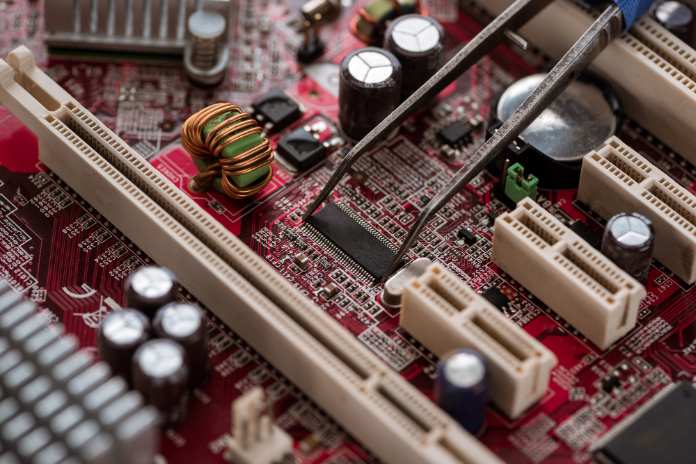

Featured Image: DepositPhotos @ VadimVasenin