In recent years, QuantumScape (NYSE:QS) has captured the attention of investors and industry experts alike due to its groundbreaking work in solid-state battery technology. As the automotive industry increasingly shifts towards electric vehicles (EVs), QuantumScape’s innovations could play a pivotal role in shaping the future of energy storage solutions.

QuantumScape has developed a solid-state lithium-metal battery that promises to deliver significant advantages over traditional lithium-ion batteries. These include higher energy density, faster charging times, and improved safety features. Such advancements are crucial as automakers seek to enhance the performance and appeal of EVs to a broader market.

Looking forward to the next three years, several factors could influence QuantumScape’s stock trajectory. First, the company’s ability to scale production of its solid-state batteries will be critical. Currently, QuantumScape is working on expanding its production capacity with plans to build a pilot production line. Success in this area would not only validate their technology but also strengthen their position in the competitive battery market.

Moreover, partnerships with established automakers are essential for QuantumScape’s growth. The company has already secured a significant partnership with Volkswagen, one of the largest car manufacturers globally. This collaboration aims to integrate QuantumScape’s batteries into Volkswagen’s EVs, providing a substantial market opportunity for the company.

However, QuantumScape faces several challenges that could impact its stock performance. The transition from prototype to mass production is fraught with technical and logistical hurdles. Additionally, the competitive landscape for battery technology is fierce, with numerous companies vying for a share of this lucrative market. QuantumScape must continue to innovate and differentiate its products to maintain a competitive edge.

Investors should also consider the broader economic environment, which can influence QuantumScape’s stock price. Factors such as changes in government EV policies, fluctuations in raw material prices, and global economic conditions could affect the company’s financial performance.

Overall, the next three years hold significant potential for QuantumScape, but also considerable risk. Investors should remain informed about the company’s progress and the external factors that may impact its success. With its cutting-edge technology and strategic partnerships, QuantumScape is well-positioned to capitalize on the growing demand for efficient and sustainable energy solutions.

Footnotes:

- QuantumScape has partnered with Volkswagen to integrate its battery technology in future EVs. Source.

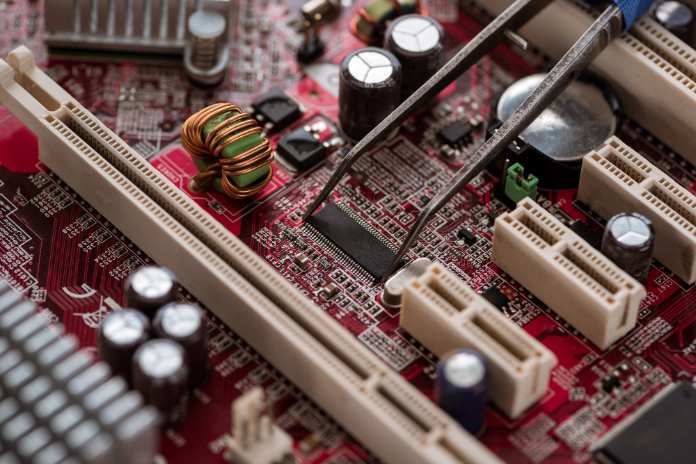

Featured Image: DepositPhotos @ VadimVasenin