Joe Rogan has never pulled punches on Big Pharma. On his podcast, he’s blasted the industry for decades. They don’t fix problems. They mask symptoms. They keep people dependent.

Now the timing is different. Because Rogan’s words line up with a quiet revolution already underway.

It’s not a new treatment. It’s not gene editing. It’s something far more natural.

They’re called peptides.

Tiny chains of amino acids. Microscopic messengers that tell your cells to repair, rebuild, and restore.

When you’re young, your body makes plenty of them. As you age, the signals fade. That’s when the problems begin: weight gain, fatigue, wrinkles, slower recovery.

For years, only the wealthy could access peptides. They paid thousands for injections and infusions at private clinics. But the secret slipped out.

Elon Musk has been linked to semaglutide, a peptide reshaping the conversation on weight management.1

Jennifer Aniston has spoken about peptide injections as the future of anti-aging skincare.2

Chelsea Handler admitted to turning to weight loss peptides herself.3

And Meg Ryan’s own makeup artist swears by a peptide-rich serum for her skin.4

The message is clear. Celebrities are already using them. Tech titans are experimenting with them. Athletes swear by them.

But there’s one massive problem.

Almost every peptide therapy still requires a needle.

Expensive. Invasive. Intimidating. And for millions of people, that’s the deal-breaker.

Until now.

For the first time, a new delivery system is tearing down that barrier. Capsules. Creams. Wearable patches. The same powerful compounds… without the needle.

That’s the breakthrough. That’s the opening for mass adoption.

Buried in the small-cap shadows is Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) with a tiny $8.65 million valuation. Exactly the kind of structure that can potentially send a stock sprinting when demand finally hits.

The Roadblock That’s Kept Peptides Out of Reach

Peptides get the buzz. But there has always been one problem.

Needles.

For decades, the only way to take peptides was through injections or IV infusions. That meant cold clinics, high costs, and intimidating procedures.

Most people stopped right there. The idea of mixing powders, loading syringes, and sticking yourself every day was too much.

That barrier kept peptides locked away. The wealthy paid concierge doctors. Athletes pushed through the pain because performance mattered. Celebrities endured it because looking younger was part of the job.

For the average person, it was never an option.

That is where Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) comes in.

Instead of needles, Pangea is making peptides simple. Capsules you swallow. Creams you rub in. Wearable patches that release benefits all day long.

No injections. No IV lines. Just everyday access.

It is a breakthrough that changes the entire game.

Now peptides are no longer a luxury for the few. They can become a mainstream wellness tool for the many. The science has not changed. The benefits are the same. But the delivery is finally practical, painless, and affordable.

That is why Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) could be on the verge of doing what no one else has done. Bringing peptides into homes, gyms, and daily wellness routines across North America.

Wall Street Already Proved Peptides Are Big Business

The question isn’t whether peptides work.

Wall Street already answered that.

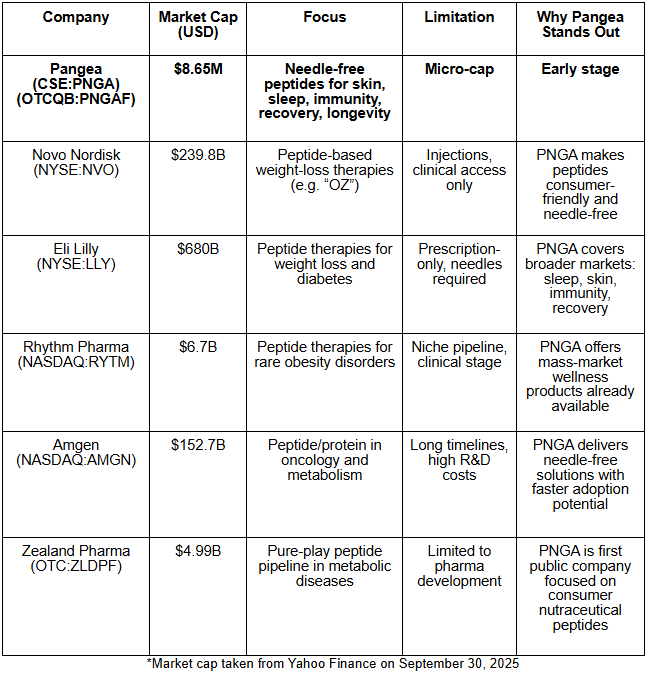

Look at the companies dominating the market today.

Novo Nordisk became one of Europe’s most valuable companies with a $600 billion market cap because of one peptide-based weight-loss treatment. Its stock surged as celebrities, athletes, and everyday people lined up for access to the “OZ” treatment making headlines in Hollywood.

Eli Lilly is now worth more than half a trillion dollars, powered by the same class of peptide therapies. The company has grown into one of the most valuable on the planet because it leaned into the peptide revolution early.

Smaller firms are seeing the same trend. Rhythm Pharmaceuticals, Zealand Pharma, and others built their pipelines around peptides and Wall Street rewarded them with billion-dollar valuations.

The message is clear. Peptides are no fad.

They are the foundation of modern medicine. And the market is willing to pay billions for exposure.

But here’s the catch.

Every one of these giants is tied to injections and clinical pipelines. The benefits are locked behind needles, prescriptions, and expensive treatments.

That’s where Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) breaks from the pack.

Instead of chasing one weight-loss therapy or a years-long trial, Pangea is bringing peptides to consumers today. Capsules. Creams. Wearable patches. The same building blocks trusted by Hollywood and Big Pharma made simple, safe, and needle-free.

It’s a strategy that could open a much larger market than weight loss alone. Skin. Sleep. Immunity. Recovery. Longevity. Everyday wellness.

While Big Pharma fights for clinical dominance, Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) is opening the door to the mass market.

Press Releases

- Amino Innovations Develops Next-Generation Peptide Patch Platform to Redefine Everyday Wellness

- Amino Innovations Expands Market Presence Alongside Global Health Leaders Gary Brecka, Lara Trump, and Tito Ortiz at Leading Biohacking and Longevity Summits

- Pangea Provides Corporate Update on Peptide Products and Delivery System Pipeline

- Pangea Natural Foods Inc. Announces Non-brokered Private Placement of Special Warrants for Gross Proceeds of up to $2,900,000

- Pangea Natural Foods Inc. to Consolidate its Common Shares

Peptide Market Comparison

It is easy to see Novo Nordisk at $239 billion today and forget where it started.

In the early 1980s, Novo was not a giant. It was a niche insulin maker in Denmark. Its market value was tiny. Less than $300 million.

Few investors even knew it existed.

Then came the breakthrough. Synthetic human insulin.

It was the first of its kind. A peptide innovation that rewrote the rules of treatment. Suddenly, Novo was not a small player anymore. It was on the map.

From there, Novo doubled down. It invested heavily in peptide research. For years, it was ignored. But it kept building.

Then came the weight-loss therapy that Hollywood cannot stop talking about. The one whispered about as “OZ.”

That single therapy transformed Novo into Europe’s most valuable company. One peptide. Hundreds of billions in new market value.

Eli Lilly tells the same story.

For decades, it was just another midsize American med developer. Its market cap floated in the hundreds of millions.

Wall Street barely paid attention.

But Lilly saw the promise of peptides. It focused on diabetes and metabolic disease. Slowly, it built credibility. Then it scaled.

When its peptide therapies took off, Lilly went vertical. Today it is worth $680 billion.

That is what one strategic move on peptides can do.

Even the smaller names show the same pattern.

Zealand Pharma once traded for pennies. Its market value sat under $200 million. Then its pipeline of peptide-based therapies gained traction. Now it commands billions.

Rhythm Pharmaceuticals started the same way. A small-cap biotech. Less than $300 million in value. Focused on rare disorders.

Investors who spotted the peptide angle early saw Rhythm grow into a company now worth billions.

The message is clear.

Great small-cap peptide companies do not stay small forever.

And that is exactly where Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) comes in.

Like Novo and Lilly in their early years, Pangea is “really small”. It trades at a micro-cap valuation. It is still under the radar.

But it has the one ingredient that changed the game for every other company in this story: innovation.

Novo had synthetic insulin. Lilly had its diabetes peptides. Zealand and Rhythm had their rare-disease breakthroughs.

Pangea Natural Foods (CSE:PNGA) (OTCQB:PNGAF) has something equally disruptive.

Needle-free peptides.

Capsules. Creams. Wearable patches. The same class of compounds trusted by celebrities, athletes, and billionaires, but made simple and safe for the mass market.

This time the opportunity is even bigger.

Because Novo and Lilly only targeted one segment: weight loss and diabetes.

Pangea is targeting them all.

Skin. Sleep. Immunity. Recovery. Longevity.

That makes the total addressable market far larger.

Hollywood proved the demand. Big Pharma proved the profits.

Now Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) is proving you do not need a needle to capture them.

The giants were once small. Then they broke out.

Pangea could potentially be next.

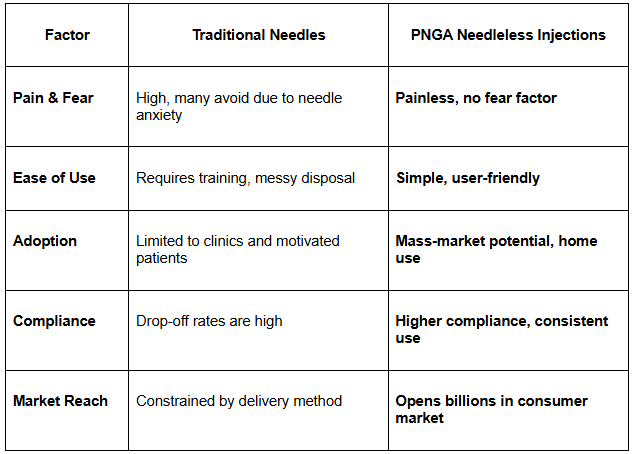

The Breakthrough Technology

Most people want better health and longevity. But there’s a problem: injections.

Even when the science is proven, adoption stalls because the average person does not want to jab themselves with a needle week after week. It creates friction, fear, and drop-off.

Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) is solving this barrier with a game-changing innovation: needleless peptide injections.

Why does this matter? Because it takes peptides out of the lab and the clinic and puts them into the mainstream consumer market. When people can use therapies comfortably at home, adoption skyrockets.

Think of it this way: the weight loss boom with the “OZ” craze only went mass-market once the delivery system became simple and repeatable. Now imagine the same effect happening with peptides, only faster.

Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) has a first-mover advantage in this space. Their needleless system could unlock an addressable market measured not in millions, but billions.

And early investors know that solving adoption is where exponential returns are born.

Every once in a while, a company captures a massive shift in consumer health. Hims & Hers did it with telehealth. Novo Nordisk did it with weight-loss peptides. Now Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) is aiming to do the same in longevity and wellness, only at today’s tiny valuation.

8 Reasons

Why This Could Potentially Be the Next $1 Billion Health Breakout

1

Needle-Free Breakthrough: The major barrier holding peptides back are injections.5 Most people will never commit to syringes, mixing powders, or IV infusions. By making peptides available in capsules, creams, and wearable patches, this company eliminates the friction that has kept them confined to elite circles.

2

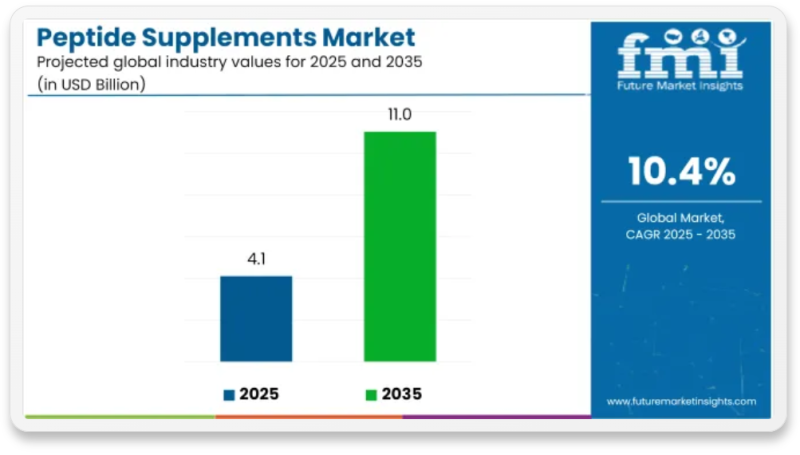

Multi-Billion Dollar Market: The global peptide therapeutics market is forecast to surpass $11.2 billion by 2035,6 and that does not even include consumer wellness. Peptides are where weight-loss pills were five years ago: ignored by Wall Street, yet coveted by celebrities and early adopters.

3

Celebrity Momentum: Celebrities are already proving the demand is real. Elon Musk has been linked to peptide-based weight management, Jennifer Aniston has spoken about peptide injections for skincare, Chelsea Handler has admitted to weight-loss peptides, and Meg Ryan’s makeup artist highlights a peptide serum as her secret.

4

Medical Credibility: Science matters. A strong network of medical experts gives legitimacy to what could otherwise be dismissed as just another health fad. This credibility is key to driving adoption beyond celebrities and athletes into the mainstream.

5

Recurring Revenue Potential: Peptides are not a one-time treatment. They are used daily, weekly, or monthly, creating natural subscription-style revenue. That kind of repeat business is the backbone of scalable consumer health companies.

6

Proof From Novo Nordisk: Novo Nordisk was once a modest European insulin maker, valued in the low hundreds of millions. Then one peptide-based weight-loss therapy transformed its trajectory. At its peak, Novo was worth more than $600 billion, making it one of the most valuable companies in the world. This is the ultimate validation that peptides are not just science, they are big business.

7

First-Mover Advantage: Few companies are solving the delivery problem. Injections remain the standard. Being first with needle-free peptides creates defensibility and gives this company a head start in building brand loyalty.

8

Ground-Floor Pricing: This is still a micro-cap stock. Institutions are not in yet. That gives individual investors the rare chance to participate early, before the rest of the market wakes up to the opportunity.

Why Needle-Free Peptides Could Be the Next $1 Billion Health Trend

When Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) acquired Amino Innovations in April 2025, it wasn’t just buying another product line. It was staking its future on what could be the single biggest health breakthrough of the decade.

For years, peptides sat trapped in clinics and biohacker circles. They worked — science proved that — but they were locked behind needles, powders, syringes, and intimidating regimens.

If you weren’t a celebrity with a concierge doctor or an athlete willing to inject yourself daily, you were cut off.

Amino Innovations was built to change that. And Pangea (CSE:PNGA) (OTCQB:PNGAF) now owns it.

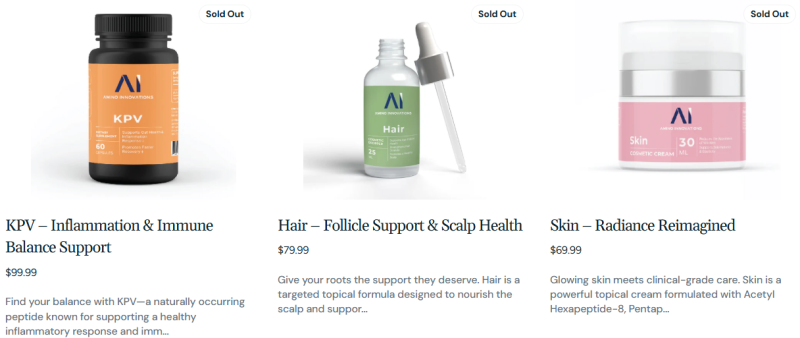

The Flagship Lineup

In mid-2025, Amino launched its first seven products, each tailored to a different piece of the booming wellness market:

- CHILL: A capsule with Pinealon peptide plus calming botanicals, formulated to ease stress and sharpen focus.

- SKIN: A copper peptide, infused cream designed to boost elasticity and repair skin, tapping directly into the multi-billion-dollar anti-aging industry.

- BPC: High-absorption BPC-157 capsules for athletes and fitness enthusiasts, targeting muscle, joint, and gut recovery.

- KPV: Oral capsules featuring lysine–proline–valine, an anti-inflammatory tripeptide that supports immunity.

- AGELESS: A longevity blend that pairs Epitalon, one of the most studied anti-aging peptides, with NMN to support energy and mitochondrial health.

- BLUE: A nootropic capsule using methylene blue, a brain-boosting compound for focus, clarity, and memory.

- HAIR: A serum combining Copper Tripeptide-1 with Zinc Thymulin to nourish the scalp, stimulate follicles, and promote regrowth.

Each product has one thing in common: it eliminates the needle. That shift alone takes peptides from niche to mainstream.

Direct-to-Consumer First

The company isn’t relying on slow-moving retail to get started. Amino launched online in June 2025, with US e-commerce sales already underway. The website positions the products like high-end nutraceuticals: clean branding, science-backed claims, and a direct pitch to health-conscious consumers.

But online is just the beginning. In August, Amino showcased the lineup at TheFitExpo Anaheim, one of the biggest health expos in North America. More than 20,000 people walked through the event. Amino’s booth drew lines, collected thousands of emails, and created a surge of social media content that extended well beyond the convention floor.

That kind of grassroots buzz is how small health brands go viral. It’s how you build communities that reorder every month, share testimonials, and attract influencers organically.

The Unit Economics

What really stands out is the economics. According to company projections:

- Oral delivery costs just $6.98 per unit, yet retails for about $150. That’s over $131 gross profit per capsule bottle.

- Topicals cost about $7.90 and sell for the same $150, leaving margins above 90%.

- Even the more advanced peptide patches — expected to debut in late 2025 — still generate margins north of 75%.

On the consumer side, the math is just as compelling. Customer acquisition costs are projected at $60–75, while the average first purchase lands around $300. With subscriptions, that number rises to $200 per month.

In plain English: for every $1 spent on marketing, the company expects $4–6 in revenue. That’s the same kind of math that powered Hims & Hers, Herbalife, and Thorne HealthTech into billion-dollar valuations.

Why Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) Has an Edge

Most startups in this space would struggle with production and compliance. Pangea doesn’t. The company already operates a CFIA- and FDA-approved facility in Surrey, British Columbia. That’s where it makes its own products and where it now manufactures Amino’s entire line.

This facility is more than just a factory. It’s an asset most microcaps can’t dream of. It allows Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) to scale quickly, ensure quality, and keep margins high.

And beyond its own products, the company offers co-packing and private-label manufacturing to other wellness brands. That means the plant is both a growth engine and a potential profit center, creating B2B revenue streams alongside consumer sales.

The Roadmap Ahead

The first wave of products is already on sale. But the second wave could be even bigger.

Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) is developing a needle-free peptide patch, expected to roll out by Q3 2025. Imagine a simple, wearable strip that releases peptides steadily over 24 hours. No pills to swallow. No creams to apply. Just a patch you stick on and forget.

Sublingual (under-the-tongue) delivery is also in development, promising faster absorption for certain peptides. These innovations could expand the market even further, appealing to consumers who want maximum convenience.

Riding the Market Wave

Timing matters. The global peptide supplement market is forecast to grow from $4.1 billion in 2025 to $11.2 billion by 2035, with annual growth around 10.4%.7 At the same time, the broader peptide therapeutics market — still dominated by injectables like the “OZ” weight-loss miracle — is expected to surpass $155 billion by 2034.8

Consumers already believe in peptides. They’ve seen the headlines. They’ve watched celebrities slim down or glow on camera. They just haven’t had an easy way to buy in.

Now they do.

Why Investors Are Watching

This is where the investment case crystallizes.

Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF), with a market cap around $8.65 million, is trading like a microcap food company. But with Amino Innovations, it has transformed into a first-mover in peptide wellness.

It owns a ready-to-scale product line, controls its own manufacturing, and operates in a market with double-digit growth tailwinds.

The company is small now. But so were Hims, Thorne, and countless others before Wall Street woke up.

Amino Innovations is the pivot point. It’s the reason investors are starting to see PNGA not as a plant-based patty maker, but as a biotech-meets-wellness play sitting at the front of a multi-billion-dollar trend.

And if Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) delivers on even a fraction of its roadmap — patches, retail expansion, wholesale partnerships — the numbers suggest the upside could be dramatic.

Scarcity Creates Leverage in the Market

Sometimes what moves a stock isn’t the size of the company. It’s the size of the float.

Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) has just ~28.27 million shares outstanding.9 But here’s where it gets interesting.

Not all of those shares are free to trade. The April 2025 acquisition of Amino Innovations was an all-stock deal for 12 million shares issued at $0.20, most of them locked up in escrow with staged releases over two years.10 Add in insider holdings and restricted stock, and you’re left with a float of only around 14.4 million shares.

That is tiny.

For perspective, many health and biotech peers trade with 40–60 million shares in their float. Some have hundreds of millions.

When a float is this lean, the dynamic changes. A few million dollars of volume can move the stock in ways that look outsized compared to large caps. Sometimes a strong press release, a new distribution deal, or an early revenue milestone is enough to attract attention and spark momentum.

This doesn’t guarantee direction. It means scarcity magnifies demand. If interest grows faster than supply unlocks, the price reacts. That’s why traders and institutions scan for structures like this. The float becomes a kind of leverage built into the stock itself.

For Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF), it’s another layer of intrigue. A company repositioning around peptides at exactly the moment mainstream awareness is growing. And a share structure where the float is a fraction of peers. That combination is rare, and it’s why small-cap investors are watching closely.

The Team Driving the Needleless Revolution

Every breakout in health and biotech has a core group of visionaries who see the shift before everyone else. Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) is no different.

At the center is Pratap Sandhu, Founder and CEO. He isn’t a biotech outsider dabbling in wellness trends. He’s a builder with a track record of taking products from concept to the shelves of major grocery chains like Whole Foods and Loblaws. That distribution know-how is critical. In the supplements game, it’s not enough to have a breakthrough product, you need to know how to scale it. Sandhu has done it before, and now he’s applying that playbook to peptides.

Backing him is Dr. Navdeep Bains, Chief Science Officer. Bains brings a deep bench in nutraceutical development and functional ingredients, guiding the formulations that give Amino’s products credibility. He’s the one making sure that what goes into each capsule, serum, or patch isn’t just marketable, it’s science-backed.

The acquisition of Amino Innovations also brought in a dedicated leadership team with biotech and consumer health roots. Amit Arora, President of Amino, has spent two decades in product commercialization across health and wellness. He’s already been the public face of the new peptide line at expos and trade events, positioning the brand directly in front of tens of thousands of early adopters.

Together, this mix of operators, scientists, and marketers gives Pangea something most micro-caps lack: balance. They can design products that stand up to scientific scrutiny, manufacture them in FDA- and CFIA-approved facilities, and then push them through the exact channels where health products break out first.

It’s this combination of vision and execution. From the lab bench to the store shelf. It’s the type of company that investors look for in the early innings of a category-maker. Pangea’s (CSE:PNGA) (OTCQB:PNGAF) team isn’t chasing a trend. They’re building the infrastructure to own it.

The Window Into a Market About to Break Open

Every health boom starts the same way. A small company spots the shift early, builds a product that removes the barriers, and suddenly what was niche becomes mainstream.

That’s exactly where peptides are today. The science is proven. The demand is exploding. And for the first time, they’re being delivered in a way that makes sense for the mass market.

Pangea Natural Foods Inc. (CSE:PNGA) (OTCQB:PNGAF) has put itself at the center of this transformation. A small float. A lineup of science-backed, needleless peptide products. And a management team with the track record to move quickly.

But here’s the thing: details matter. To see how the pieces really fit together, from product pipeline to revenue model to financial structure, you need to read the company’s own words.

We’ve made that easy.

Subscribe now to unlock the full corporate presentation.

Inside, you’ll see how this micro-cap is positioning itself in one of the fastest-growing corners of health and longevity.

The next wave of wellness is forming. The question is who will catch it early.