Elon Musk has made a bold claim.

He says Tesla’s energy storage business will grow even faster than its car business.1

And he is proving it with Powerwalls in homes and Megapacks on the grid.2

Bill Gates agrees. His Breakthrough Energy Ventures has backed battery startups all over the world.3

Jeff Bezos followed.

Google has also written checks into next-generation battery companies so it can run on clean power all day and all night.4

Even Robert Downey Jr. is investing through his FootPrint Coalition.5

The message is clear. The billionaires know energy storage is the choke point of the clean energy future. Without it, solar and wind collapse the second the sun sets or the wind dies.

Now there is a new problem. AI and crypto are pouring fuel on the fire.

Data centers are spreading across America. They are so power hungry that utilities are warning of major cost spikes.

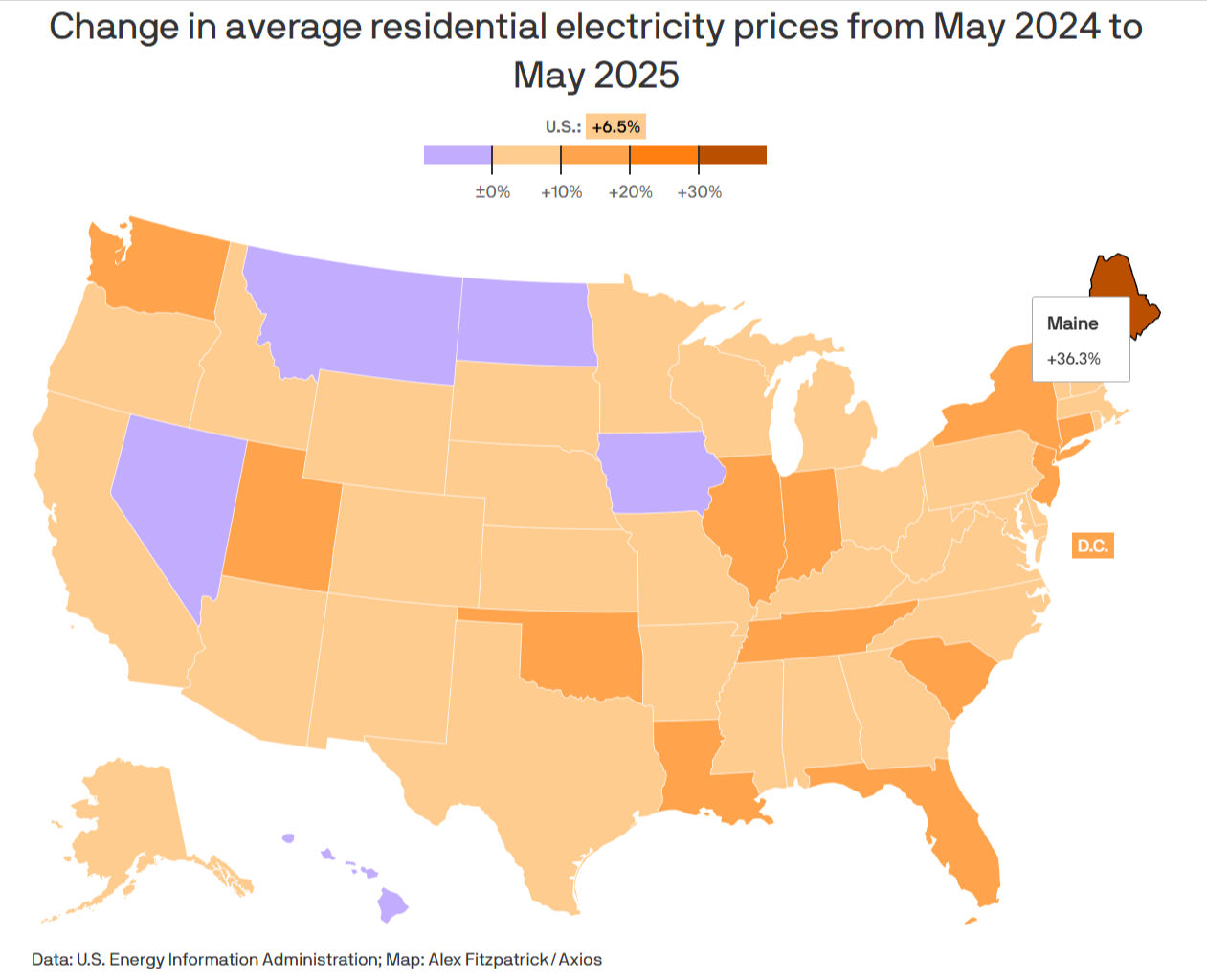

Analysts say US electricity prices could rise by 8% nationwide by 2030 and have already risen by 6.5% since 2024.6

In hot spots like Northern Virginia, bills could jump 25%.7

In the PJM grid, covering 13 states, residential rates could surge 30% to 60% by 2030.8

Families are already seeing it. In Virginia, average bills climbed 3% in just one year.9

The strain on the grid is real. Households are desperate for backup. Utilities are passing costs on. And the giants are racing to keep up.

Tesla. Enphase. Generac. They are already worth billions.

But there is one overlooked company on Nasdaq. A pure-play battery stock. It trades at just $177 million.

This company has posted triple-digit growth.

It has multimillion-dollar distributor deals from Texas to Puerto Rico.

And thanks to a recent acquisition, its batteries can now be installed in 30 minutes.

That means any licensed electrician can put one in a home. It could unlock mass adoption overnight.

And while Trump’s new tariffs are set to hammer foreign imports, this company’s US and Austrian supply chain puts it in the sweet spot. Instead of paying the penalty, it could benefit.

The billionaires have pointed the way. AI and crypto have made the crisis urgent. And this tiny US battery stock, Neovolta Inc. (NASDAQ:NEOV) may be the breakout story of America’s next energy boom.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

Elon Musk Proved the Model. Here’s Who Could Perfect It

Elon Musk saw the weak link years ago. Solar quits at night. Wind fades when the air is still. Without batteries, clean power falls apart.

So he pushed into storage. Tesla rolled out Powerwall for homes and Megapack for the grid.

In 2024 the energy segment deployed 31.4 GWh and became a real business, not a side project. You can see it in Tesla’s own filings and updates.10,11

Here is the opening for investors. Powerwalls often take hours to install. Special crews. More time. More cost. That slows adoption in the very market that needs speed.

Neovolta Inc. (NASDAQ:NEOV) attacks that choke point.

The company signed an LOI to acquire strategic assets of Neubau Energy, positioning the combined entity to capture a significant share of the rapidly expanding residential energy storage market while avoiding anticipated 2026 battery import tariffs that could exceed 28%.12

The goal is simple. Cut typical installs from about four hours to roughly 30 minutes so any licensed electrician can do the job. That is how you scale.13

Speed matters because demand is building fast.

- AI and data centers are pushing the grid hard.

- Bills are rising and outages are getting more attention.

- Homeowners want control and backup.

- Installers want jobs that go in clean and fast.

Neovolta Inc. (NASDAQ:NEOV) is lining up the other pieces too.

It partnered with Virtual Peaker so home batteries can join virtual power plants and get paid for helping the grid. That turns a box in the garage into a small income stream in many markets.14

And it is not just talk. Neovolta Inc. (NASDAQ:NEOV) is shipping into Puerto Rico with Barrio Eléctrico under a DOE-backed program that targets up to 1,000 homes. That is proof of need and proof of field installs.15

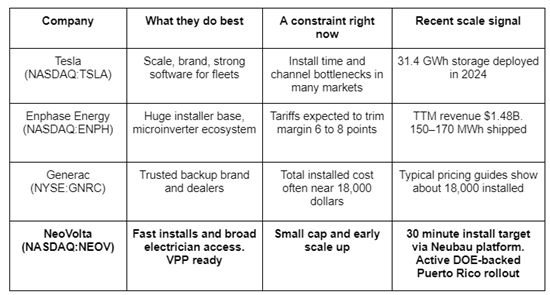

What about the rest of the field? Tesla has scale and strong software. But installs can be slow and the pipeline is heavy with demand. That leaves space for faster movers.

Enphase has a large installer base and shipped about 150 to 170 MWh of batteries in Q1 2025 with $356.1 million of revenue that quarter. The company also warned new tariffs could hit gross margin by 6 to 8 points once older inventory clears. That kind of pressure can slow growth.17,18

Generac is a household name in backup power. PWRcell is popular, but a typical package often ends up around $18,000 installed. That price limits who can buy and how fast it spreads.19,20

There are many other brands in the mix. Panasonic EverVolt. Canadian Solar EP Cube. Sonnen eco. FranklinWH. EcoFlow’s new Ocean Pro.

It is a crowded shelf with more than a dozen credible options in US home storage today.21

Press Releases

- NeoVolta Enters Into Asset Purchase Agreement for Neubau Energy’s Next-Generation Battery Platform; Expects Transaction to Be Immediately Accretive to Revenues and Gross Margins

- NeoVolta Reports Fiscal Year 2025 Revenues of $8.4 Million, up 219% from Year Ago

- NeoVolta Celebrates RE+2025 Successes & Recaps Announcements

- NeoVolta Unveils Its 250kW / 430kWh Commercial & Industrial BESS at RE+ 2025; Availability Beginning in Q4 2025

- NeoVolta Enters Into Letter of Intent to Acquire Neubau Energy’s Next-Generation Battery Platform

Here is why NeoVolta (NASDAQ:NEOV) can still win share:

- It targets the pain the others leave behind.

- Fast installs that multiply the number of crews who can do the work.

- A platform that slots into everyday electrician workflows.

- VPP software hooks so homeowners can join grid programs.

- And live programs that prove the business model in places that need resilience now.

To keep this easy to scan, here is a compact snapshot to compare the core edge and the most recent scale signal.

That is the story in plain language. Musk proved storage is the key and built a giant. The field is crowded, but most players carry install time, channel, or cost weight.

NeoVolta (NASDAQ: NEOV) goes straight at those weak spots with speed, simple installs, and live grid programs that pay.

The smartest money in the world has already made its bet.

Elon Musk proved storage can outgrow cars, while Gates, Bezos, and Google are all betting big on batteries.

They all know the same thing. Whoever controls storage controls the future of energy.

But here’s what Wall Street has missed.

Most of the public names are already giants. Tesla trades at hundreds of billions. Enphase and Generac are worth billions too. For regular investors, the biggest upside is long gone.

That’s why NeoVolta (NASDAQ: NEOV) stands out.

It is still small. About $177 million in market cap.

Yet it is already growing faster than the industry average, has a proven product, and is attacking the exact bottleneck slowing down the big guys.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

8 Reasons

Why NeoVolta (NASDAQ:NEOV) Could Be America’s Next Energy Winner

1

The Musk Blueprint Is Already Proven: Elon Musk showed the world that battery storage is bigger than cars. Tesla’s energy segment generated over $10 billion in 2024 revenue.22 The model is real. NeoVolta (NASDAQ:NEOV) is applying the same idea in a pure-play format that isn’t buried inside a trillion-dollar giant. Investors get direct exposure to the storage boom.

2

Faster Installs Mean Faster Growth: Tesla’s Powerwall can take hours to put in place. NeoVolta (NASDAQ:NEOV) is moving toward 30-minute installs with its Neubau platform. That opens the door for thousands of electricians — not just specialized solar crews — to do the work. Faster installs mean more systems in homes and faster revenue growth.

3

Triple-Digit Growth Is Already Happening: This is not a startup with only a prototype. NeoVolta (NASDAQ:NEOV) has delivered three straight record quarters and projected fiscal 2025 revenue to more than triple last year. Distributor orders have already topped millions. The growth story is alive and accelerating.

4

Big Institutional Backers Are On Board: Around 31% of shares are already in institutional hands with giants like Vanguard and Fidelity having taken positions.23 That is a powerful vote of confidence for a company with a market cap of just $177 million.

5

Live Government-Backed Programs: NeoVolta Inc. (NASDAQ:NEOV) is part of a Department of Energy–backed program in Puerto Rico that targets up to 1,000 home installs.24 More than 100 systems are already in place. That shows the batteries work in the field and are being funded by real programs that matter.

6

Tariffs Hurt Rivals, Help NeoVolta: Trump’s new 2026 tariffs on imported batteries could be as high as 34% for China.25 Enphase already warned investors its margins will drop once old inventory runs out. NeoVolta, with its US and Austrian supply chain, is one of the few positioned to thrive. Policy headwinds for others become tailwinds here.

7

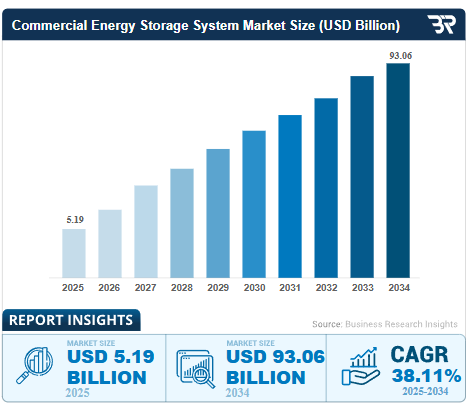

Expanding Into Commercial and Grid Markets: NeoVolta (NASDAQ:NEOV) is not stopping at homes. A 250 kW / 430 kWh commercial system is set to launch in Q4 2025.26 That opens the door to schools, factories, and utilities — a $5.19 billion US market that is still underserved.

8

Pure-Play Status in a Crowded Market: Most competitors are conglomerates. Tesla is focused on cars. Generac is tied to generators. Enphase leans on solar inverters. NeoVolta (NASDAQ: NEOV) is one of the few public companies focused entirely on storage. For investors who want a direct way to play America’s $45 billion storage boom, this is it.

Each of these reasons on its own would be enough to turn heads. Together, they create one of the most powerful setups I have seen in years.

Think about it. Triple-digit growth. Institutional money already in the stock. Government-backed installs proving the product in the field. And a supply chain designed to thrive under new tariffs that could crush competitors.

That is NeoVolta Inc. (NASDAQ:NEOV).

A pure-play battery company sitting in the right place at the right time.

The big names (Tesla, Enphase, Generac) already proved the demand.

Now an overlooked challenger has a chance to capture market share with a faster, easier solution.

This is where fortunes are made in emerging industries. The giants prove the concept. Then a small, nimble company with the right edge takes off before Wall Street catches on.

And that is exactly why investors are paying attention to NeoVolta Inc. (NASDAQ:NEOV) right now.

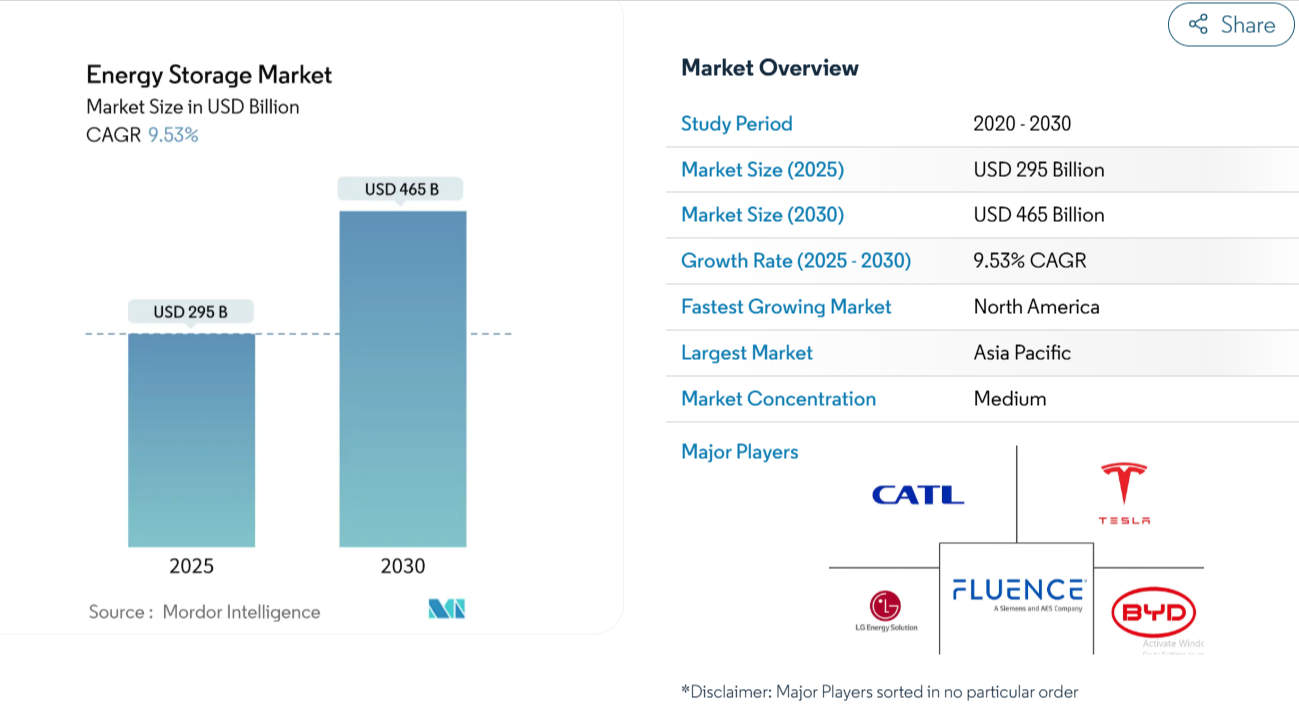

Why NeoVolta (NASDAQ:NEOV) Is Winning in the Fast-Growing $465 Billion Storage Market

The US storage market is on an unprecedented pace of growth.

By 2030, it is expected to reach more than $465 billion annually (currently $265 billion) across residential, commercial, and services with North American being the fastest growing market.27

Families want it because electricity bills are rising.

Businesses want it because blackouts are costly.

And utilities want it because batteries stabilize the grid when demand spikes.

Here’s the catch: most systems are still too slow, too complex, or too expensive.

Tesla’s Powerwall works, but a full install often runs $11,500 to $15,000 depending on size and labor. Enphase’s IQ batteries cost about the same, and installers complain about complexity. Generac’s PWRcell often comes in around $18,000 installed.

NeoVolta Inc. (NASDAQ:NEOV) built its systems to be more practical.

The flagship NV14 and NV24 units are lithium iron phosphate batteries, which are safer and longer-lasting than many lithium-ion chemistries. They are modular, expanding from 14.4 kWh up to 54.4 kWh, so a family can start small and scale as their needs grow.

The inverter and energy management software are built right in, so installers don’t need multiple boxes and parts.

And thanks to the pending Neubau platform, installation can take just 30 minutes, compared with four hours or more for rivals. That cuts labor costs and opens the door for thousands of electricians to join the installer base.

Pricing depends on installer and region, but distributor and installer sources show NeoVolta systems generally land in the $12,000 to $14,000 installed range28 — competitive with Tesla, but with faster installs, modular growth, and more flexibility.

In April 2022, NeoVolta Inc. (NASDAQ:NEOV) earned a powerful stamp of approval.

Its NV14 home battery was ranked by EnergySage as one of the most affordable solar storage systems in America.

This wasn’t opinion, it was data.

EnergySage analyzed millions of quotes sent to US homeowners in 2021.

And NeoVolta’s NV14 came out ahead of more than 20 brands.29

It beat the cost per kilowatt-hour of giants like Sonnen, Enphase, LG, Generac, Panasonic, and SunPower.

Think about that.

A small-cap challenger under $200 million just undercut some of the biggest names in the world and did it with a product already shipping into homes.

For homeowners, it means real savings.

For investors, it means NeoVolta Inc. (NASDAQ:NEOV) has proof it can compete toe-to-toe in one of the most competitive markets in energy.

That’s why demand is picking up fast.

In fiscal 2025, NeoVolta (NASDAQ:NEOV) grew revenue from $590,000 in Q1 to $2.01 million in Q3.30

The company projects more than $8 million in revenue for the year, representing over 200% year-over-year growth.31 Distributor purchase orders topped $3 million in a single quarter, and the backlog continues to build.

Growth is not limited to one state.

NeoVolta started in California, but has since expanded distribution into Texas and other high-cost power markets.

In Puerto Rico, the company is part of a Department of Energy backed program to deploy up to 1,000 home systems through Barrio Eléctrico, with more than 100 already installed.

And with its new 250 kW / 430 kWh commercial system set to launch in late 2025, NeoVolta is moving beyond homes and into schools, factories, and utilities.

A market currently worth $5.19 billion annually growing to 93.06 billion in 2034.32

That is how a $177 million market cap company begins to play on the same field as billion-dollar rivals.

Tesla proved storage is the future. Now, NeoVolta Inc. (NASDAQ:NEOV) is showing how faster installs, modular systems, and real government-backed programs can make it a contender in the US and beyond.

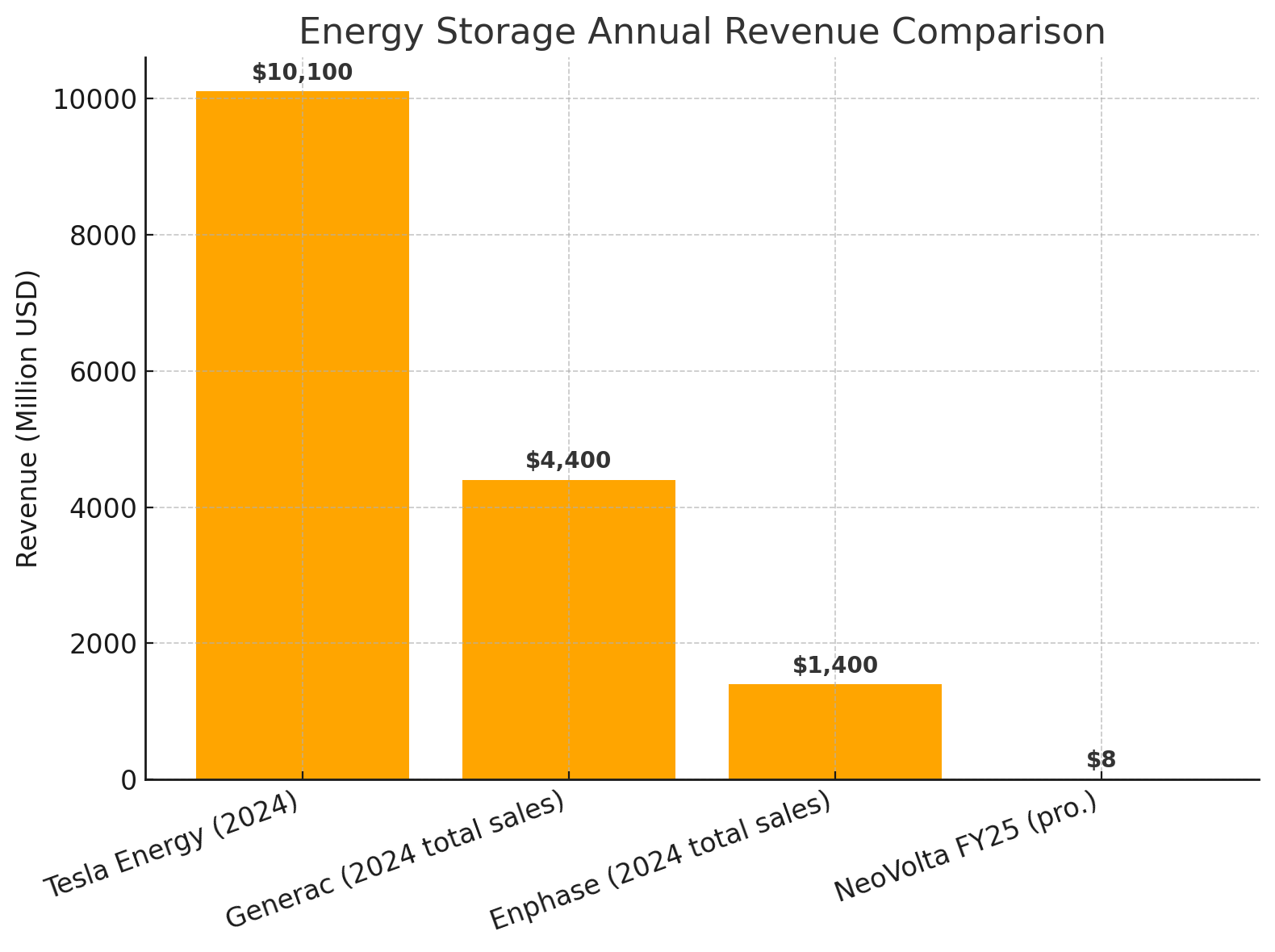

Look at the gap on this chart.

Tesla booked more than $10 billion in storage revenue last year.33

Enphase pulled in $1.4 billion over the last year.34

Generac sits at roughly $4.4 billion in annual revenue.35

And then there’s NeoVolta Inc. (NASDAQ:NEOV). Projected revenue this year is only about $8 million. That’s tiny compared to the giants, but that’s where the opportunity lies.

Because this is exactly how the big stories begin. The leaders already proved the market. They showed storage is essential and profitable. Now a small, overlooked pure-play like NeoVolta can carve out market share at a pace the giants can’t match.

Investors aren’t being asked to bet on a dream. NeoVolta Inc. (NASDAQ:NEOV) already has record growth, multimillion-dollar orders, and government-backed installs in the field. The only thing missing is Wall Street catching on.

Trump’s Tariffs Could Potentially Be The Tailwind That Pushes Revenues Even Higher

Politics usually create chaos in energy. But this time, policy could hand NeoVolta Inc. (NASDAQ:NEOV) an edge.

Starting in 2026, Trump’s new tariffs are set to slap up to a 34% penalty on imported batteries. That’s devastating for rivals who rely on China and Southeast Asia.

Enphase already told investors margins could drop by 6%-8% points once old inventory runs out.

That’s billions in lost profit.

But NeoVolta Inc. (NASDAQ:NEOV) will not feel that pain. Its supply chain runs through the United States and Austria.

No tariff hit. No sudden squeeze.

Instead, while rivals raise prices or take margin cuts, NeoVolta moves ahead with a clean runway.

That turns policy from a headwind into a tailwind.

And for a small-cap stock with a $177 million valuation, that shift could be explosive.

The Dream Team Behind NeoVolta (NASDAQ:NEOV)

Every breakout company has a team that turns vision into reality.

Tesla had Musk and his Powerwall crew.

Enphase had veteran technologists who scaled inverters worldwide.

Now NeoVolta Inc. (NASDAQ:NEOV) has its own dream team and they’ve done this before.

This isn’t a group of paper-pushers. It’s a team of operators who have scaled billion-dollar businesses, built global energy supply chains, and managed programs bigger than most public companies.

Now they’re focused on one mission:

Turning NeoVolta Inc. (NASDAQ:NEOV) from a pure-play small cap into America’s next energy powerhouse.

8 Reasons

NeoVolta (NASDAQ:NEOV) Could Be America’s Next Energy Winner

1

Musk proved the model that storage is bigger than cars

2

Installs in 30 minutes, not hours

3

Triple-digit revenue growth already happening

4

31% of shares in institutional hands

5

DOE-backed programs with systems in the field

6

Trump’s tariffs crush rivals, help NeoVolta

7

Expansion into commercial and grid markets

8

Pure-play exposure in a $465B storage market

The giants have already shown the demand is real.

Now a small, nimble company with faster installs, government-backed programs, and triple-digit growth is stepping into the spotlight.

NeoVolta Inc. (NASDAQ:NEOV) is sitting at just a $177 million market cap.

That’s where the biggest upside lives.

This is exactly how the most explosive stories begin. First the giants prove the concept.

Then an up-and-coming challenger with the right edge takes off before Wall Street wakes up.

Don’t wait until the crowd catches on.

Subscribe now and download our latest investor deck to see the full story on NeoVolta (NASDAQ:NEOV).

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers