One Overlooked Quebec Junior Could Be Sitting on the Next Big Discovery

Gold just blew through $4,100 an ounce.

It did not sneak higher. It blasted upward like a signal flare.

A government shutdown in Washington.¹

Trade war threats between the United States and China.

And central banks are buying more gold than at any time in modern history.

Now the US is about to impose 100 % tariffs on Chinese imports starting November — a major escalation.²

That combination has created a perfect storm for investors.

The dollar is weakening. The Fed is hinting at rate cuts.³ Markets hate chaos. Gold feeds on it.

And a wave of money is pouring into anything connected to real, tangible value.

But here is the twist.

Yet while macro forces drive gold higher, opportunity lies in the ground. Most investors chase ETFs or bullion. Very few look at the miners that could actually produce the next ounce.

One of those underlooked names is Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF).

With a market cap of around $47 million, it is still flying under the radar.

Yet it controls something most juniors only dream about. A fully permitted, fully refurbished 750-tonne-per-day gold mill, and an expanding gold resource in the most prolific mining region in Canada.

This is the Abitibi Gold Belt, a geological treasure with past production and current reserves/resources sitting at over 300 million ounces (Moz) of gold, making it one of the world’s most prolific gold districts.⁴

It is home to legendary discoveries and billion-dollar takeovers.

Names like Agnico Eagle, Eldorado, and Osisko have built empires here.⁵

Now a new generation of explorers is following in their footsteps.

Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) sits right in the heart of it, surrounded by operating mines and infrastructure that make development faster and cheaper.

Its Swanson Gold Project lies just an hour north of Val-d’Or, connected by road and rail to the company’s Beacon Gold Mill, a $70 million replacement-value facility that could be restarted for roughly $5 million.⁶

And now, the company has taken the next major step toward production: engaging global mining consultancy Environmental Resources Management (ERM) to complete a Preliminary Economic Assessment (PEA) that will model the restart of the Beacon Mill using feed from Swanson.⁷

The study will define the path to near-term gold production, positioning Lafleur as one of the few juniors in Quebec with a realistic plan to pour gold in the next 12 months.

That’s what makes Lafleur different — it’s not just exploring, it’s executing.

At the helm is Kal Malhi, a serial entrepreneur who has raised more than $300 million for early-stage ventures, supported by CEO Paul Ténière, P.Geo., a veteran geologist and mine builder with over 25 years of experience.⁸

Behind them is Louis Martin, the exploration advisor whose discoveries have shaped Quebec’s modern gold landscape.

Together, this team has turned Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) into what most juniors only dream of: ownership of a mill + resource + permits.

In a world flooding into gold, they may be among the few who make that gold.

While gold dominates global headlines, this quiet player in Quebec could be one of the biggest stories most investors have not yet heard.

And what happens next at its flagship mill and project could define the next phase of the Abitibi gold rush.

The Proof Is Already in the Tape

Every gold cycle has its breakout stories.

The ones that start small, get ignored, and then explode once investors see they can actually produce.

In 2020, West Red Lake Gold Mines (TSXV:WRLG) was one of them.

It was a small Ontario explorer trading around $25 million in market cap.

Then it bought a permitted mill, restarted its mine, and within eighteen months, its value climbed over $400 million.⁹

That’s what happens when a junior moves from “potential” to “production.”

Another one was Nicola Mining (TSXV:NIM).

It followed the same path, but in British Columbia.

Nicola already owns a permitted mill (Merritt) and began accepting high-grade ore from Talisker in mid-2025, generating early revenue while still maintaining leverage.

Its stock is up over 150% since May, more than doubling in just a few months.¹⁰

Those two stories share something in common. They had real infrastructure before the rest of the market noticed.

That is exactly what Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) has right now.

A fully permitted 750-tonne-per-day mill, with expansion capacity. A defined gold resource in a district-scale advanced exploration stage project, focused on consolidating additional claims to further enhance its footprint. And a restart plan that could move it from exploration to production in the same way those others did.

But unlike those companies, Lafleur Minerals (CSE:LFLR) (OTCQB:LFLRF) has one more advantage: it sits in the heart of Quebec’s Abitibi Gold Belt, one of the richest gold regions on earth.

This is where world-class producers like Osisko Mining and Probe Gold (TSX:PRB) built their reputations.

Osisko’s became one of the most talked-about high-grade gold developments in Canada, driving Osisko’s valuation well above $600 million before it was acquired by Gold Fields in 2024 for roughly $1.5 billion.¹¹

That buyout proved how valuable a producing-scale Abitibi asset can be once the market catches on.

Probe Gold’s Val-d’Or East Project tells a similar story. Located just 60 kilometers from Lafleur’s Beacon Mill, the project holds over 10 Moz (MI&I)¹² and trades around $595 million.¹³

Probe’s PEA outlines strong production economics and an extended mine life, cementing it as another Abitibi success story born from scale, location, and timing.

They’re proof of what this region produces. Big mines, big discoveries, and big winners.

Now compare those valuations to Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) (FSE:3WK0).

With a market cap near $47 million, it’s barely visible on the radar.

Yet it controls infrastructure with an independent replacement value of $71.5 million and a fully permitted mill that could be restarted for roughly $5 million.

That kind of disconnect doesn’t last forever.

Investors have seen this movie before. The small Quebec player with a mill, a resource, and a plan to restart, quietly rerating as progress unfolds.

It’s not a question of if the market will catch on, but when.

And that’s what makes Lafleur Minerals (CSE:LFLR) (OTCQB:LFLRF) one of the few stories in Canada that could transition from exploration to production in months, not years.

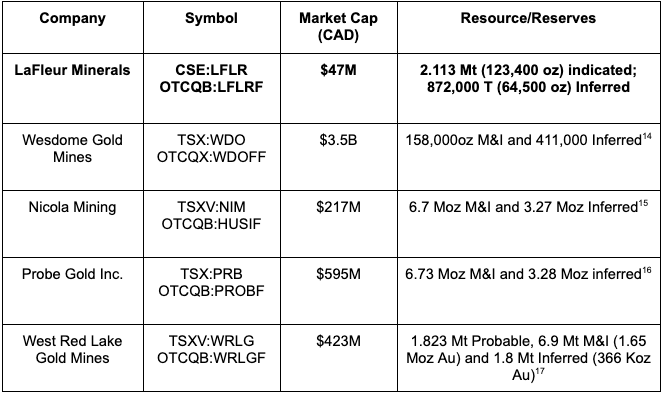

Here’s how it stacks up against its neighbours and peers:

*Market cap taken from Yahoo Finance on October 14, 2025

The numbers speak for themselves.

Every name on that list started small before the market finally priced in what they owned.

Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) (FSE:3WK0) already owns the mill.

It already has the permits.

And it’s sitting in one of the richest gold districts on the planet.

The only thing the market hasn’t done yet is notice.

And that’s where the next part of this story begins.

If you believe gold is entering a new era and that infrastructure, jurisdiction, and timing matter, then Lafleur Minerals (CSE:LFLR) (OTCQB:LFLRF) stands out as one of the most compelling juniors in North America.

Here are eight reasons this stock deserves close attention today.

Top 8 Reasons

Investors Should Be Watching Lafleur Minerals (CSE:LFLR) (OTCQB:LFLRF) Right Now

1

Tiny Valuation, Big Asset Base: With a market cap of about $47 million, Lafleur Minerals remains under the radar. The company owns a fully permitted and refurbished 750-tonne-per-day gold mill in Quebec, independently valued at more than $71 million in replacement cost estimates.¹⁸ That means the market is valuing the entire company at less than the worth of a single key asset, without any credit to its district-scale exploration asset that holds its own upside potential.

2

Mill, Tailings, and Ore Under One Roof::Most juniors have one or two pieces of the puzzle. Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) controls all three. The Beacon Gold Mill, a fully permitted tailings facility, and the Swanson Gold Project are all within trucking distance of each other. That rare combination creates a shorter path to production and lowers development risk, positioning LaFleur as a vertically integrated near-term gold producer.

3

Proven Jurisdiction – Abitibi Gold Belt: The Abitibi region has produced more than 200 Moz of gold with total reserves, resources, and past production exceeding 300 Moz. It’s home to established names like Agnico Eagle, Osisko Mining, and Probe Gold. Lafleur Minerals operates in the same world-class corridor, surrounded by infrastructure, expertise, and proven deposits. Quebec is ranked among the top five mining jurisdictions globally by the Fraser Institute..

4

Near-Term Restart Potential: The Beacon Mill can be restarted for an estimated $4 million to $6 million. With permits already in place and infrastructure built, Lafleur Minerals (CSE:LFLR) (OTCQB:LFLRF) could transition from developer to producer faster than most early-stage miners that must build from the ground up..

5

Exploration Upside at Swanson: The Swanson Gold Project carries a 2024 NI 43-101 resource: Indicated 123,400 ounces @ 1.8 g/t and Inferred 64,500 ounces @ 2.3 g/t. Drilling has returned high-grade results such as 7.47 g/t Au over 1.35 m and 17.80 g/t Au over 1.0 m. The deposit remains open in multiple directions, and the company plans additional drilling to target a potential one-million-ounce resource.

6

Toll Milling and Early Revenue Options: Owning a mill means flexibility. Before feeding its own ore, Lafleur Minerals can process ore from nearby producers and generate revenue. This strategy helps fund exploration and de-risks operations while positioning the mill as a regional hub.

7

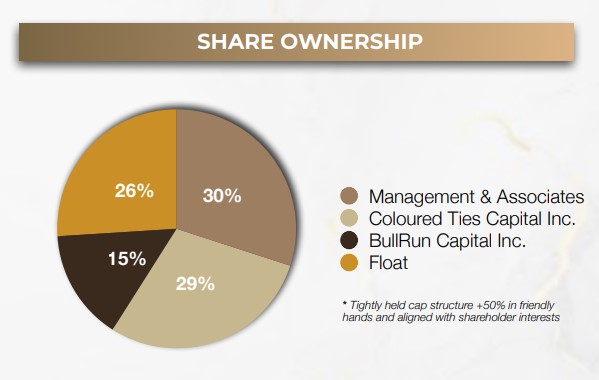

Tight Share Structure and Insider Alignment: The company has about 70 million shares outstanding and over 60% insider, strategic ownership and friendly hands through groups like Bull Run Capital Inc. and Coloured Ties Capital Inc. When insiders hold significant stakes, their interests align closely with shareholders.

8

Catalyst-Rich 2025 and 2026 Timeline: The months ahead are packed with potential catalysts. Beacon Gold Mill restart planning, Swanson bulk-sample permitting, the upcoming Preliminary Economic Assessment, and continuous drill results could all move the needle. Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) is entering a phase where every update matters.

The setup is clear. The gold market is on fire, and few juniors have both real assets and near-term production potential.

Next, let’s look inside those assets to see how the Beacon Mill and Swanson Project could turn this quiet junior into Quebec’s next production story.

The Beacon Gold Mill Is The $70 Million Asset Hidden in Plain Sight

Every great mining story begins with the same rare advantage: infrastructure that already exists.

For Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) that advantage is the Beacon Gold Mill.

Located in Val-d’Or, Quebec, the Beacon Mill sits in the heart of Canada’s Abitibi Gold Belt, surrounded by power, roads, and rail.

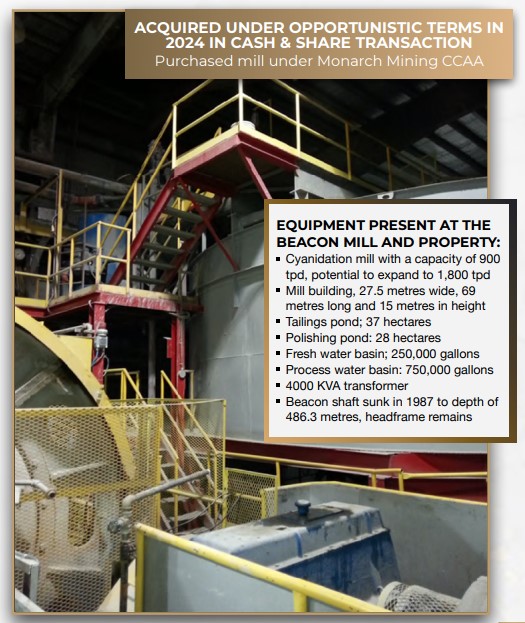

It is a fully permitted and refurbished 750-tonne-per-day gold processing facility with a history of production and a clear path to restart. The site includes a mine, tailings management facility, water systems, and underground infrastructure that are already in place.¹⁹

When Lafleur Minerals (CSE:LFLR) (OTCQB:LFLRF)purchased Beacon Gold Mill out of Monarch Mining’s CCAA process in 2024, it acquired more than a plant.

It acquired time.

Monarch had spent nearly $20 million upgrading the facility before bankruptcy, leaving behind a modernized mill that required only maintenance and inspection to restart operations.²⁰

Independent engineers from Bumigeme Inc. later confirmed that the Beacon Gold Mill’s replacement cost exceeded $71.5 million. Their report estimated rehabilitation and re-commissioning at roughly $4–6 million, a fraction of the price of building a new facility²¹ and saving exponential time (3-4 years) in terms of permitting

That valuation instantly positioned Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) among the few juniors in North America whose balance sheets are anchored by tangible infrastructure.

The Beacon Gold Mill is already authorized by the Government of Quebec to process up to 750 tonnes per day, with optional capacity expansion to 1,100 tpd. The existing tailings pond is approved for 1.8 million tonnes of material, equal to about nine years of processing at full throughput.²²

Unlike typical exploration stories that depend on future builds, this one is about acceleration. Restart work has already begun.

Equipment inspections, maintenance scheduling, and parts inventories are underway through engineering partner ABF Mines, which is preparing a final restart plan and budget for submission to Quebec regulators.²³

Once operational, Beacon Gold Mill will not only handle ore from the company’s Swanson Gold Project but will be able to accept third-party material from nearby producers.

That flexibility opens the door to early revenue through toll milling, a strategy proven successful by peers such as Nicola Mining (TSXV:NIM), whose smaller 200 tpd facility in British Columbia generated income long before its own mine reached steady production.²⁴

For Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF), Beacon Gold Mill is the engine that transforms potential into performance. In a market where juniors can spend years and millions on permitting, Lafleur already holds the keys.

Economically, the mill’s leverage is striking. With gold trading above US$4,000/oz, the margin between processing costs and potential output widens daily.²⁵

A fully operational mill capable of 30,000 ounces per year could generate substantial cash flow, even at conservative head grades. The company’s scoping work will finalize production profiles once the Swanson bulk-sample and permitting sequence concludes.

Beacon’s strategic location makes that scenario even more powerful. Val-d’Or is the nucleus of Quebec’s mining infrastructure. The district hosts more than 100 historic and operating mines, power lines within kilometers of site, and a skilled labor base accustomed to mill operations.²⁶

This environment gives Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) (FSE:3WK0) a jurisdictional advantage that most global juniors simply do not have.

Quebec ranks fifth worldwide in the Fraser Institute’s 2023 Survey of Mining Companies for policy perception and investment attractiveness.²⁷

The mill’s economics are compelling, but its symbolism may be even stronger. Investors remember what happened when West Red Lake Gold Mines (TSXV:WRLG) acquired its permitted Madsen Mill. The market recognized the path to production, and the company’s valuation climbed from under $30 million to more than $400 million within a year.²⁸

Beacon Gold Mill puts Lafleur Minerals (CSE:LFLR) (OTCQB:LFLRF) on a similar trajectory. The difference is timing. The global gold market has never looked stronger, and very few juniors can claim to be this close to production while maintaining such a small market capitalization.

From a purely financial perspective, Beacon is undervalued.

From a strategic perspective, it is irreplaceable. There are only a handful of permitted mills in Quebec, and new approvals take years. Owning one outright gives Lafleur optionality, bargaining power, and a head start on every competitor still waiting for paper to clear.

As the company completes its restart plan and advances non-dilutive financing options for commissioning, investors will finally begin to see what management has envisioned since 2024. Beacon Mill is not just an asset. It is the foundation of a business model built for scalability.

For Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF), this is the moment when exploration turns into execution. Once the mill is turning, the story shifts from what the company could do to what it is doing.

And every mill needs ore. Just 66 kilometers north of Val‑d’Or lies the Swanson Gold Project.

The deposit that will feed Beacon and could push Lafleur into the ranks of Quebec’s next generation of producers.

Press Releases

The Swanson Gold Project Is The Source That Feeds the Mill

Just north of Val-d’Or, along the same geological corridor that produced more than 200 million ounces of gold, sits the Swanson Gold Project.

This is where the story of Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) (FSE:3WK0) moves from infrastructure to discovery.

Swanson is not just another exploration play. It is a near-surface deposit sitting on a mining lease with roads, power, and water already in place. It is exactly the kind of project that can feed the Beacon Gold Mill and generate real ounces in the near term.²⁹

The property covers approximately 18,300 hectares, a large and strategic land position within the Abitibi Gold Belt. Historical exploration totals more than 36,000 meters of drilling, including over 27 documented gold showings across multiple zones.³⁰

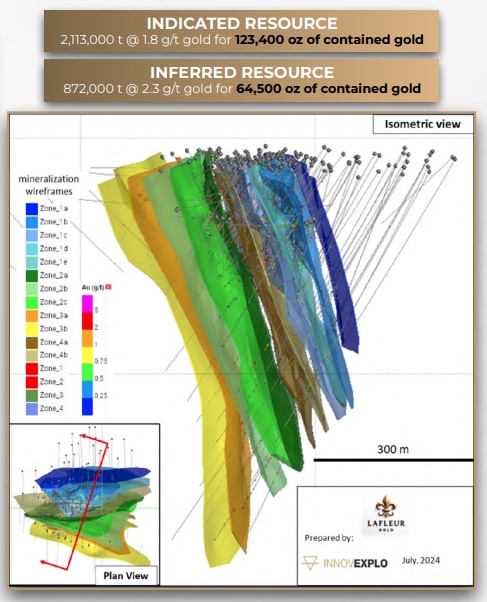

In 2024, Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) released its updated NI 43-101 mineral resource estimate prepared by InnovExplo. The report defined:

- Indicated Resources: 2.113 million tonnes grading 1.8 g/t gold for 123,400 ounces

- Inferred Resources: 0.872 million tonnes grading 2.3 g/t gold for 64,500 ounces.³¹

Those figures were only the beginning.

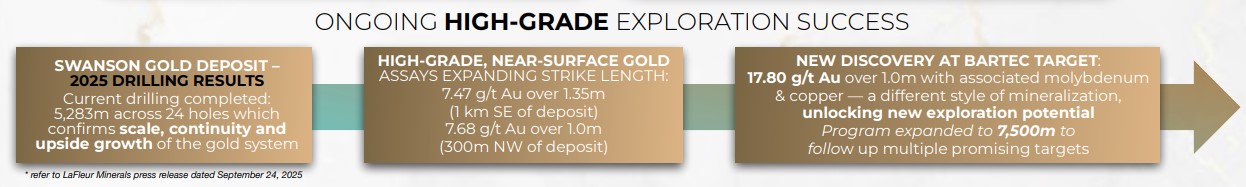

The 2025 drill campaign is already expanding the deposit at depth and along strike. New assays have returned high-grade results, including 7.47 g/t gold over 1.35 meters (SW-25-033) and 17.80 g/t gold over 1.0 meter (SW-25-037) at the Bartec target. Another hole, SW-25-038, intersected a 17.9-meter sulphide-rich zone with assays pending.³²

Drill results like these matter because they confirm a consistent, high-grade structure across the Swanson property.

The mineralization remains open in all directions, giving Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) (FSE:3WK0) multiple opportunities to increase the resource base through ongoing exploration.

The company has also begun the permitting process for a bulk sample of up to 100,000 tonnes from the Swanson deposit. This bulk sample is more than a technical exercise. It is a bridge to production. It allows Lafleur to test metallurgy, refine processing parameters at the Beacon Mill, and validate recovery rates before full-scale mining.³³

Few juniors reach this stage so quickly. Having both the source and the processing plant under one roof positions Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) far ahead of typical early-stage explorers that still need to negotiate off-take or mill access agreements.

Swanson’s location adds another layer of value. The road network between the two is already operational, minimizing capital costs and simplifying logistics.

The deposit also benefits from the same robust infrastructure that defines the Abitibi region. Power lines, water access, and workforce availability make development faster and more cost-efficient.

But Swanson is not just about ounces in the ground. It is about scalability. The mineralized structures extend into underexplored zones such as Jolin, Marimac, and Bartec, all of which exhibit gold-bearing intersections. These targets will form part of the company’s next drill program, designed to define additional near-surface tonnage and build long-term mill feed.

For Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) Swanson represents sustainable growth. It provides a foundation of known gold resources and a platform for expansion.

As drilling continues and new assays arrive, the picture becomes clearer: this is not a single deposit, but a district-scale opportunity with multiple high-grade zones.

Each new meter drilled adds confidence, value, and potential feed for Beacon. Together, these assets form a vertically integrated model that few juniors can match: a permitted mill, a gold resource with expansion potential, and a jurisdiction built for mining.

As the company moves forward with its 2025 exploration program and bulk sample permitting, investors are watching closely.

The results from Swanson could unlock the next phase of growth and solidify Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) (FSE:3WK0) as one of Quebec’s few near-term gold producers.

And while Swanson grows, the bigger story remains unchanged. Every ounce discovered here feeds directly into a facility that already exists.

That combination of discovery and delivery is what separates Lafleur Minerals from the rest of the field.

The Countdown to Production Has Already Begun

Momentum in the gold market is rising, and so is the pace of progress at Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF).

While other juniors wait for approvals or funding, this company is already executing on multiple fronts.

Each of these milestones can serve as a potential trigger for the next re-rating phase.

- 7,500 Meters of Drilling Underway: The 2025 exploration program is expanding the Swanson Gold Project along strike and at depth. More than 7,500 meters are planned, targeting high-grade extensions at Bartec and Jolin. Early assays have already confirmed 7.47 g/t gold over 1.35 meters and 17.80 g/t over 1.0 meter.³⁴

- Bulk Sample Permit in Progress: The company has submitted a 100,000-tonne bulk sample from Swanson. This will allow metallurgical testing at the Beacon Mill and validate recovery rates before commercial mining begins. Management expects approvals in early 2026.³⁵

- Beacon Mill Restart Plan Nearing Completion: Engineering firm ABF Mines is finalizing the Beacon restart plan and budget. Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) intends to submit the full restart package to Quebec regulators by the end of 2025. That milestone moves the project closer to near-term production.³⁶

- Fully Funded for Current Work Programs: The company recently completed a $2.88 million LIFE financing at $0.48 with two-year $0.75 warrants, followed by a $553,000 private placement.³⁷ This funding covers the current drill campaign, engineering studies, and regulatory filings without additional dilution.

- Preliminary Economic Assessment (PEA) on Deck: Once drilling and metallurgical data are finalized, a new PEA will be launched in 2026 to integrate the Beacon Mill and Swanson Project into a single economic model. That assessment could provide the first glimpse of potential annual gold output and cash-flow estimates.³⁸

- Expanding Exploration Footprint: Geologists are now targeting additional zones including Bartec and Jolin, two areas with historical gold showings that remain underexplored.³⁹

- Continuous News Flow Through 2026: With assays pending, engineering updates underway, and bulk-sample approvals expected, Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) is entering a stretch of back-to-back catalysts. Each new release has the potential to reshape how investors view the company’s near-term production profile.

The pieces are already in motion.

From the Beacon Mill restart plan to drilling at Swanson, the next 12 months could define this company’s trajectory in the heart of the Abitibi Gold Belt.

And behind this sequence of milestones is a leadership team that has built and financed mines before.

They are the reason these deadlines feel achievable, not theoretical.

The Team Turning Potential Into Execution

Behind every successful gold story is a team that knows how to turn a project into a mine.

For Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF), that experience runs deep.

The company is led by proven mine builders, capital market veterans, and geologists who have already helped shape Quebec’s mining industry.

Kal Malhi serves as Executive Chairman and Founder.⁴⁰ He is a serial entrepreneur who has raised more than $300 million for early-stage ventures and helped launch several publicly traded companies in Canada and the United States. Malhi has a reputation for identifying undervalued opportunities and moving them through the development cycle efficiently.

His financial background and access to capital are a cornerstone of how Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) plans to accelerate Beacon Mill toward production.

At the operational level, Paul Ténière, P.Geo., serves as Chief Executive Officer. Ténière brings more than 25 years of experience in geology, mine development, and technical reporting under NI 43-101 standards.

He has worked on both open-pit and underground operations across North and South America and has served in senior roles with listed mining companies and consulting firms. His expertise ensures that every technical disclosure from Lafleur Minerals meets the highest industry standards.

Supporting the technical strategy is Louis Martin, P.Geo., Senior Exploration Advisor. Martin is a respected figure in Canadian exploration with more than 40 years of experience in gold and base metals. He previously held senior roles with Clifton Star Resources. Mr. Martin has been fortunate to be part of the exploration teams that were awarded the Discovery of the Year by the AEMQ for the West Ansil Deposit (2005) and the Louvicourt Deposit (1989). Martin’s understanding of Abitibi geology is guiding Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) (FSE:3WK0) as it targets extensions of the Swanson resource and new satellite zones such as Jolin and Marimac.

The company also benefits from the insight of Jean Lafleur, P.Geo., a veteran exploration geologist and namesake of the company. Lafleur has worked with Placer Dome and Appian Capital and has been directly involved in several gold and copper discoveries in the Abitibi region. His experience and name recognition within Quebec’s mining community give the company strong local credibility and relationships with regulators and contractors.

Peter Espig also joined Lafleur as a Strategic Advisor and Consultant focused on the capital markets and assisting with the funding of the Swanson and Beacon Gold Mill projects. Espig also brings substantial experience in managing the funding, construction, ramp up, and operation of gold and silver milling and processing facilities in Canada.

He served as Vice-President at Goldman Sachs Japan where his team participated in more than $10 billion in structured deals, capital raises, and cross-border transactions. Prior to Goldman Sachs, he was Vice-President at Olympus Capital, a New York-based private equity firm and played a pioneering role in some of the earliest SPAC transactions, totaling over US$1.2 billion, bringing deep experience in disciplined capital deployment and turnaround execution. Since 2013, Espig has served as President and CEO of Nicola Mining Inc. and is a board member of ESGold Corp and First Lithium Minerals.

Strategically, Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) also enjoys the backing of significant shareholders who are aligned with management. Insider ownership sits at roughly 60%, held primarily by Bull Run Capital and Coloured Ties Capital.⁴¹

This high insider stake limits dilution and signals confidence that the team believes in the value they are building.

Together, these leaders form a rare mix of financial strength, technical knowledge, and regional experience. They understand how to raise capital, execute complex engineering programs, and work with Quebec’s regulatory framework to keep projects on schedule.

In a sector filled with exploration dreams, Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) stands out for having a management team capable of turning a permitted asset into a producing one.

The next phase of this story is not about plans.

It is about progress.

The Bottom Line

Gold has entered a new chapter.

It is trading above US$4,100 per ounce and investors around the world are rushing back to tangible assets.

Inflation fears, global trade tension, and a weakening dollar are driving money toward hard value again.

In this kind of market, companies that are close to production often move first.

They have leverage that pure explorers do not.

They can turn metal into cash flow.

That is what makes Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) such a unique story in the current cycle.

It owns a fully permitted and independently valued Beacon Gold Mill, an expanding Swanson resource, and operates inside one of the safest and richest gold belts on the planet.

With a market cap of roughly $47 million, Lafleur is valued at less than the replacement cost of its core asset.

At the same time, drilling, bulk-sample permitting, and mill restart plans are all advancing on schedule.

Each step moves the company closer to what many juniors only talk about: actual gold production.

Investors have seen this pattern before.

When West Red Lake and Nicola Mining began preparing their mills for restart, the market took notice.

Those stories turned small valuations into hundreds of millions of dollars in market cap.

The potential for Lafleur to follow that path is real.

The gold market rewards readiness. And right now, Lafleur Minerals Inc. (CSE:LFLR) (OTCQB:LFLRF) may be one of the few juniors positioned to deliver it.

Now is the time to learn more. Subscribe to download and review the company’s presentation.

Look at the projects. And decide if you want to be watching when the Beacon Mill comes back to life.

*All figures in Canadian dollars unless otherwise stated.