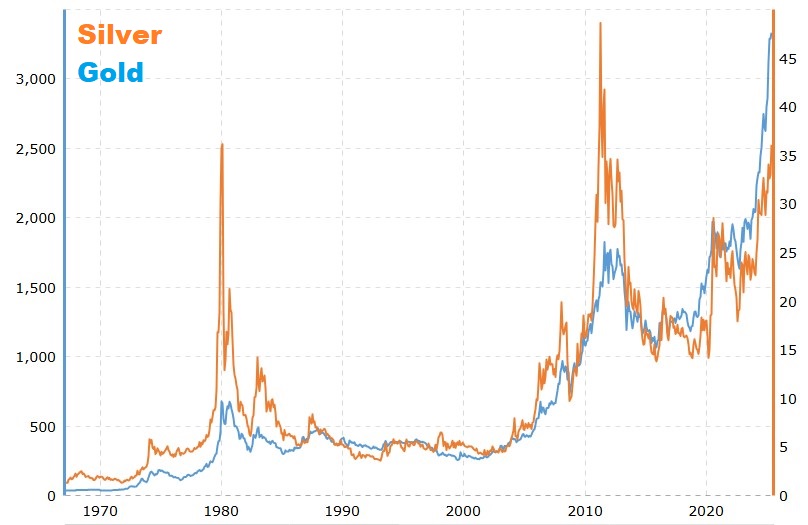

Silver’s flying.

The chart says everything.

After years of false starts, volatility, and fake breakouts, the real move has arrived.

We’re now looking at the highest silver price in over a decade, with momentum being driven not just by inflation hedges or rate cuts… but by new tariffs, persistent supply deficits,1 and record industrial demand.2

And yet, while physical silver is breaking above $48…

One of the few North American producers with four active mines, growing production, and tight costs is still trading under $15.

It’s one of the most undervalued names in silver… and Wall Street is still asleep.

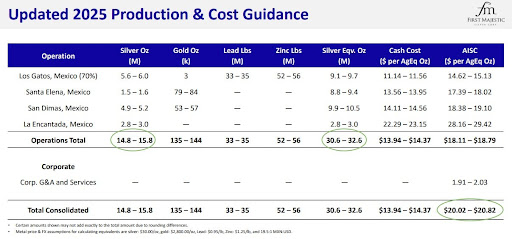

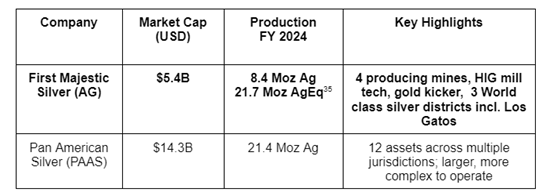

In fact, First Majestic Silver Corp. (NYSE:AG) (TSX:AG) is still valued at less than a third of some of its closest comps despite being on track to produce 30.6 to 32.6 million silver-equivalent ounces (Moz AgEq) in 2025.3

That disconnect is what this entire briefing is about.

Because this isn’t 2020 anymore.

The silver market has fundamentally changed and the institutional players are moving in:

- The Sprott Silver Miners & Physical Silver ETF (NASDAQ:SLVR) reached $348 million in assets under management (AUM)4 and First Majestic became its largest holding

- Major banks like JPMorgan,5 Citi and HSBC6 are all resetting silver price targets.

- The US has officially declared silver a critical mineral,7 unlocking federal support, fast-track permits, and reserve purchasing

- Governments are stockpiling strategic metals, especially those tied to clean energy and national security.

And yet somehow, First Majestic has flown under the radar despite boasting the highest exposure to silver amongst its competitors at 55% of revenues from silver and a healthy 35% of revenues coming from gold.

That won’t last much longer.

They’ve just completed one of the most strategic acquisitions in silver mining this cycle.

Their latest press releases show record financial results,8 surging throughput,9 accelerating underground development, and new high-grade discoveries that extend the company’s future feed.

In Q3 2025 alone, First Majestic delivered $285.1 million in revenue, a 95% year-over-year increase driven by 7.7 million AgEq ounces sold. Operating cash flow hit $141.3 million and net earnings reached $43 million, translating into one of the strongest quarters in the company’s history.10

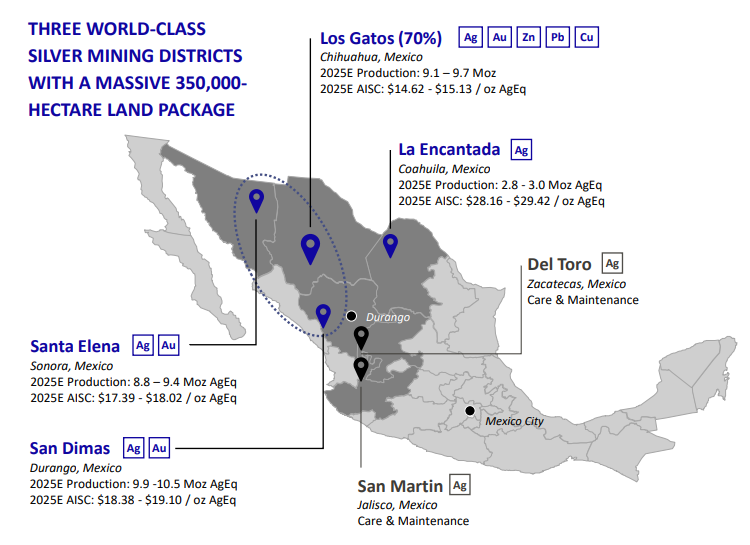

And their footprint now stretches across Mexico from the low-cost powerhouse at San Dimas to the high-grade corridor at Los Gatos.

The market’s missing it.

But we’re not.

Let’s dive into First Majestic Silver Corp. (NYSE:AG) (TSX:AG) and why this $11 stock could become one of the most compelling silver names of the entire breakout cycle.

The Silver Breakout That Caught Wall Street Off Guard

It started quietly.

Silver crept past $28, then $30, and barely anyone noticed.

But when it smashed through $35, the story changed.

That’s when the institutional money started paying attention. And by the time silver started its ascent towards $50, a new bull market was already underway and most investors still hadn’t caught on.

This isn’t like 2020. There’s no pandemic shock. No panic-driven surge. What’s happening now is structural. Global.

It was triggered the moment the president imposed aggressive new tariffs on Chinese metals.11

For years, China dominated the world’s silver supply chain. They refined it, exported it, and undercut almost every North American producer in the process.12 But when the tariffs hit, that advantage began to crack.

Suddenly, sourcing cheap refined silver became harder. Prices started to firm up. Buyers, including the US government, turned their focus to domestic and regional suppliers.

And then came the biggest signal yet: Washington formally declared silver a critical mineral, placing it in the same category as copper and rare earths, and opening the door to strategic stockpiling, subsidies, and fast-tracked mine approvals.13

That’s when the entire sector began to shift.

And right in the middle of it all sits First Majestic Silver Corp. (NYSE:AG) (TSX:AG).

While most juniors are still trying to fund feasibility studies, First Majestic is operating four active mines, with production on track to surpass 30 Moz AgEq this year14 and adding new high-grade discoveries at Santa Elena to extend its growth runway.

They’re not guessing. They’re executing. They’re selling silver into the strongest market in over a decade.

And yet… the stock hasn’t moved.

Silver is up over 50% in the last year.16 First Majestic Silver Corp. (NYSE:AG) (TSX:AG) is still under $11.

That kind of disconnect doesn’t last forever.

Especially when history is screaming what comes next.

The last time silver pulled a move like this, it was 2011. The metal soared 175% in 18 months.17 And silver stocks, especially the producers, went vertical.

In 1979, silver shot up 700% in under a year. Again, it was the producers that saw the biggest gains.

What makes this cycle different is where we are in the gold-to-silver ratio.

Right now, it still takes about 84 ounces of silver to buy one ounce of gold.18 Historically, that number averages closer to 60. Every time the ratio gets this stretched, silver plays catch-up. Fast.

Back in 2020, when the ratio spiked to 125 before dropping to 65, silver doubled.19 But the stocks? The ones with leverage? They tripled or more.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) was one of them.

Now it’s in a stronger position than ever before. Four mines. Proven low-cost structure. Proprietary milling technology that no other producer in the space uses. And margins that are expanding with every dollar silver climbs.

Meanwhile, institutions are moving.

Silver-backed ETPs took in 95 million ounces in H1 2025, pushing assets above $40 billion for the first time.20 Sprott’s new Silver Miners & Physical Silver ETF, has already surged past $384 million AUM within months of launch.

They aren’t waiting for $60 silver. They’re buying before the next leg higher.

The difference this time is the setup. We have constrained supply, rising industrial demand, protectionist policy driving domestic sourcing, and a wave of capital rotation back into metals.

And in the middle of it is First Majestic Silver Corp. (NYSE:AG) (TSX:AG), trading like it’s still stuck in 2022.

This is the window that most investors miss.

Not when silver’s at $20. Not when it drives back to $50 or higher. It’s this stretch, right before the explosive move where the biggest gains happen.

And this time, it’s not theory. It’s happening right now.

With silver breaking out and money pouring back into precious metals, the rush to find leverage is already underway. But not every silver company is built the same.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) stands out – not just for what it produces, but for who is behind it, the technology it runs, and the timing it’s positioned for.

Let’s look at why this name could be the defining silver trade of the 2025 cycle.

Press Releases

- First Majestic Announces Positive Exploration Results at San Dimas

- First Majestic Announces Record Financial Results for Q2 2025 and Quarterly Dividend Payment

- First Majestic Second Quarter 2025 Results Conference Call Details

- First Majestic Produces 7.9 Million AgEq Ounces in Q2 2025 Consisting of 3.7 Million Silver Ounces and 33,865 Gold Ounces; Announces Improved 2025 Production and Cost Guidance and Conference Call Details

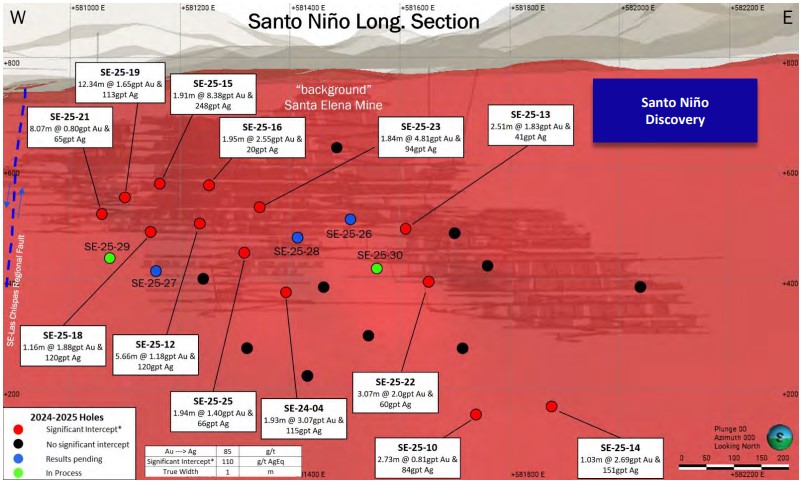

- First Majestic Announces Second Gold-Silver Discovery Within a Year at Santa Elena and Expands High-Grade Mineralization at Navidad

9 Reasons

First Majestic Could Be the #1 Silver Stock of the 2025 Bull Cycle

1

Four Mines. 30M+ Ounces Already in Production: San Dimas, Santa Elena, La Encantada, and Cerro Los Gatos are all producing and First Majestic Silver Corp. (NYSE:AG) (TSX:AG) is on track to deliver 30.6-32.6 Moz AgEq this year, while most other names in the sector are still stuck in exploration. New discoveries like Santo Niño and Navidad add future growth.

2

Low Cost Structure With Room to Expand: All-in sustaining costs around $21 per ounce21 and silver above $48. That’s a 55% margin that is rising with every dollar silver climbs.

3

Gold Production That Adds Extra Torque: Q3 2025 topped 35,000 ounces of gold.22 That gold lowers effective silver costs, strengthens free cash flow, and positions First Majestic Silver (NYSE:AG) (TSX:AG) to benefit from two precious metal bull markets at once.

4

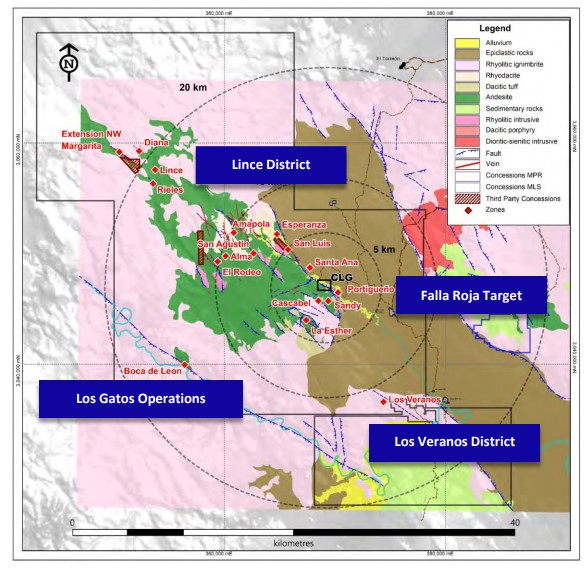

Los Gatos Is a Game-Changer: Acquired in early 2025, Los Gatos is one of Mexico’s highest-grade silver operations.23 This mine is expected to produce over 13 Moz AgEq this year24 (100% basis) and with a 100,000+ hectare land package surrounding it, it offers scale and exploration potential rolled into one.

5

No Delays, No Construction Risk, No Dilution Needed: Every mine is operating. No permits, no capex, no dilution needed (in fact, they have been buying back stock). Ounces are being pulled and monetized now.

6

The Valuation Gap Is Still There, But It May Not Last: Pan American is near $15B. First Majestic Silver (NYSE:AG) (TSX:AG) has four producing operations and meaningful gold output, and only sits near $5B in market cap, meaning AG is significantly undervalued compared to its peers.

7

Powerful Recovery Technology: Santa Elena’s High-Intensity Grinding Mill has lifted recoveries by up to 10% while lowering energy use. More ounces, lower costs, stronger margins.

8

Timing Couldn’t Be More Perfect: Silver is up 30% in months, analysts are raising targets, and macro tailwinds are back. In past cycles, triple-digit runs happened fast. AG is positioned now.

9

Keith Neumeyer May Be the Most Bullish CEO in the Sector: Keith Neumeyer called triple-digit silver long before the current move started.25 He founded First Quantum Minerals, helped launch First Mining Gold and built First Majestic Silver into one of the most recognized names in the entire mining industry. More importantly, he doesn’t hedge silver and doesn’t sell long-term value short. His conviction drives AG’s upside.

When you combine high-margin output with proprietary recovery tech, gold leverage, recent acquisitions, and Keith Neumeyer, one of the boldest CEOs in the industry, you get something rare: a producer with the tools to outperform both silver and its peers.

And the best way to understand that edge is by looking at their mines one by one. Because each of AG’s assets tells a story and together, they form the foundation of one of the most compelling setups in the entire commodity market.

But before we dive into their operations, let’s touch on a major differentiator that sets First Majestic Silver above the rest.

The Only Major Silver Miner That Mints Its Own Metal and Keeps the Premiums

While most silver producers sell their output into the wholesale market, at or near spot prices, First Majestic Silver (NYSE:AG) (TSX:AG) plays by a different set of rules.

They don’t just mine silver.

They mint it, brand it and sell it directly to retail buyers through their own online store: FirstMint.com.

They mint it, brand it and sell it directly to retail buyers through their own online store: FirstMint.com.

In 2024, the company took this model to the next level, launching its 100%-owned minting facility in Nevada.

Production began with bullion in Q1 2024 and expanded to silver coins by Q3 2024, all led by industry veterans with over 20 years of experience. In Q3 2025, First Majestic set a record with millions in sales from First Mint accounting for 11% of the Company’s total silver dore production.26

That means while other miners are settling for spot pricing, First Majestic is capturing full-stack value, including retail premiums on bars, coins, and rounds.

But minting is only part of the story. The real engine behind First Majestic’s upside is its portfolio of producing mines. These aren’t speculative projects or distant promises.

They are active operations delivering millions of ounces right now, with expansion and discovery pipelines already in motion. To see why this $11 stock has so much torque in a $48 silver market, we need to look at each of its assets up close.

The Four Pillars of First Majestic: A Closer Look at the Mines Driving This Silver Breakout

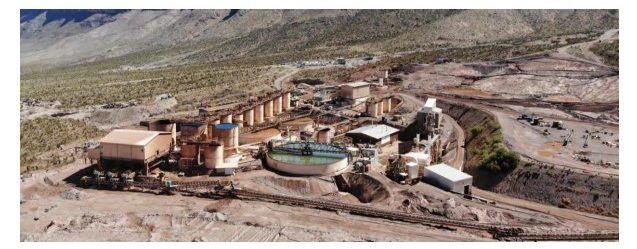

For any investor trying to understand where First Majestic’s (NYSE:AG) (TSX:AG) upside comes from, the answer lies in the rock and how efficiently they get it out.

These aren’t early-stage targets or speculative projects.

These are producing mines, actively delivering tens of millions of ounces per year, all while the silver price is climbing and margins are widening.

Let’s look closer at each operation, starting with the company’s flagship.

San Dimas: The Historic Engine with Modern Firepower

San Dimas is not just First Majestic Silver’s (NYSE:AG) (TSX:AG) largest and longest-running mine, it’s also a blueprint for modern underground silver mining.

Located in Durango, Mexico, this massive 71,800-hectare property has produced for more than 100 years. But what sets it apart today is the advanced automation AG has deployed underground, including:

- Autonomous longhole drilling

- Remote-controlled scoops and haulage

- Next-gen ventilation systems to reduce energy load

Production from San Dimas in Q3 2025 came in at 1.47 Moz Ag and 2.69 Moz AgEq, with average silver grades around 222 g/t and 13,947 ounces of gold credited.28 It remains one of AG’s most consistent and highest-performing assets.

And the future looks even brighter. First Majestic just announced positive exploration results from San Dimas, confirming new high-grade mineralization across several key zones.29

Ongoing infill drilling and expansion of the Central Block and Tayoltita veins continue to demonstrate the mine’s long-term potential without the need for major new infrastructure.

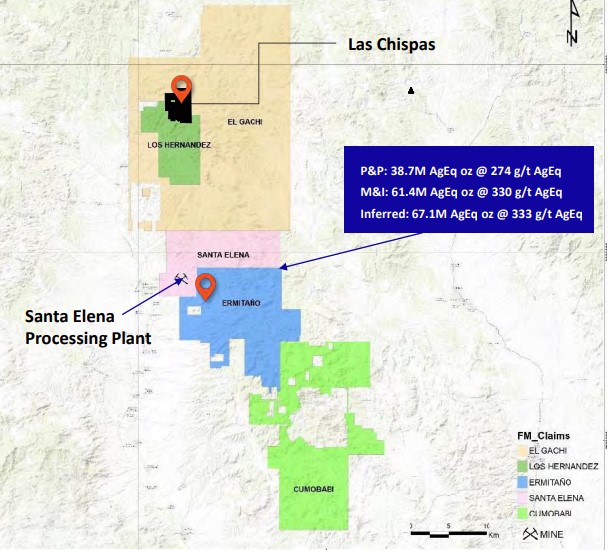

Santa Elena: Where Gold, Silver, and Technology Converge

Santa Elena is where First Majestic Silver (NYSE:AG) (TSX:AG) pushes innovation hardest, and it’s paying off.

Located in Sonora, Mexico, the Santa Elena mine isn’t just producing metal, it’s producing returns.

That’s because AG installed the industry’s first-ever High-Intensity Grinding (HIG) mill, transforming the recovery process.

The HIG mill doesn’t just crush ore, it micronizes it, creating an ultra-fine slurry that allows for vastly higher metal recovery rates. That means more ounces from the same rock and lower costs.

While traditional mills tumble ore with heavy steel balls, the HIG mill operates at far higher speeds and pressures grinding material into a superfine slurry measured in microns. That’s not just a technical upgrade. It’s a game-changer.

Why? Because finer particles expose more surface area.

More surface area means more efficient chemical contact during leaching, which translates to significantly higher metal recovery rates.

That’s especially critical when processing complex, mixed-metal feedstock from the Ermitaño satellite deposit, which is now the primary source of ore at Santa Elena.

This innovation helped Santa Elena produce 413 Koz Ag and 2.57 Moz AgEq in Q3 2025, with more than 20,000 ounces of gold included.

That dual output strengthens AG’s margins and smooths volatility in the silver market.

But Santa Elena’s real edge now is its growth pipeline.

In 2024, First Majestic made a major breakthrough with the discovery of the Navidad vein system, located less than two kilometers from the processing plant.

Early drilling identified gold and silver mineralization greater than 1,000m by 300m in strike and dip with the true thickness of mineralization averaging between 2.8m and 4.4m.30

Then in May 2025, the company struck again with a second discovery at Santo Niño, which is just 900 m south of the Santa Elena plant. Exploration drilling to date has traced the vein over 1 km of strike and 400 m downdip, with 13 intercepts to date returning significant gold and silver grades.31

With new discoveries like Santa Niño and the expansion at Navidad, fresh high-grade feed is lining up just as the HIG mill continues to deliver standout recoveries of up to 94%.

In fact, the company seems to have so much confidence in how much ore it will have in the future to feed the mill that it is investing to upgrade the mining and milling rate to 3,500 tonnes per day, from current averages of just over 3,000 tonnes per day.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) is the only silver producer in the world using this level of recovery technology, and Santa Elena is the proof of concept delivering consistent output with standout margins.

Los Gatos: The Game-Changer That Came With Room to Run

This is AG’s most recent addition, and it may be its most important.

In early 2025, First Majestic Silver (NYSE:AG) (TSX:AG) acquired 70% of the Los Gatos mine, through the acquisition of Gatos Silver.

Why does that matter?

Because Los Gatos is one of the highest-grade silver producers in the world.

In Q3 2025, it delivered 1.41 Moz Ag and 2.13 Moz AgEq, with average grades consistently over 230 g/t and a strong mix of silver, zinc, and lead.32

The mine is located in Chihuahua, Mexico. A mining-friendly jurisdiction with excellent infrastructure.

But it’s what surrounds Los Gatos that could change everything.

AG now controls over 103,000 hectares of exploration ground surrounding the mine, much of which has never seen a drill.33 According to management, the resource expansion potential is “significant,” and early geophysical targets suggest multiple parallel structures that mirror the existing resource base.

The acquisition also adds meaningful production diversity to AG’s portfolio and strengthens their ability to scale without relying on outside partners.

La Encantada: The Hidden Leverage of High-Purity Silver

La Encantada is unique. It is 100% silver with no gold or base metal exposure, making it a direct play on silver’s upside.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) is improving recovery from historic old workings and tailings, a vast low-capex resource.

With an up to 4,000 tpd mill already on site, Q3 2025 output reached 575,000 ounces Ag and 578,000 AgEq.34

It may look smaller than AG’s other mines, but with silver climbing past $48, every recovered ounce becomes a margin booster.

With reinvestment and exploration expanding beyond the breccia zones, and First Majestic focused on improving efficiencies, this “wild card” could prove more valuable than expected.

Together, these four mines form the backbone of AG’s operations and the foundation of its leverage.

Each one is producing now.

Each one has room to grow.

And each one is delivering exactly what silver-focused investors are looking for: ounces in the ground, margins on the books, and exposure to a market breaking out in real time.

Why This Silver Producer May Be the Most Overlooked Opportunity in the Sector

While the world fixates on gold’s breakout…

A different metal is stealing the spotlight.

Silver just punched through decade-highs. Tariffs and fiscal uncertainty are escalating. Industrial demand is climbing.

And yet First Majestic Silver (NYSE:AG) (TSX:AG) still trades at a valuation that defies logic.

This isn’t a pre-revenue junior hoping for a discovery.

It’s a proven producer with four active mines, advanced recovery technology, and expanding margins.

Most investors still lump AG in with the juniors. But that’s a mistake.

Because as silver surges, AG’s operating leverage gives it something most competitors don’t have: Torque.

To see why First Majestic (NYSE:AG) (TSX:AG) stands out, you only need to look at how its growth trajectory compares to the biggest name in silver: Pan American Silver.

Pan American may hold the silver crown today, producing 21.7 Moz of silver in 202436 and guiding 20 to 21 Moz again in 2025, prior to its acquisition of MAG Silver.37 That guidance is flat, showing Pan American is maintaining production rather than growing.

First Majestic, on the other hand, is on a very different trajectory.

In Q3 2025, the company delivered 3.86 Moz of silver, part of 7.7 Moz AgEq.

On the back of that performance, management raised its 2025 silver production guidance to 14.8–15.8 Moz, up from the prior 13.6–15.3 Moz range.38

That’s real growth that’s 82% higher YoY guidance in an industry where flat is the norm.

The drivers are clear. Los Gatos, now fully in-house, is ramping up to become one of Mexico’s top silver producers. At the same time, new discoveries at Santa Elena (Santa Niño and the expansion of Navidad) are building out a future pipeline of high-grade feed.

Yet today its $4.4B market cap is only about one-third of Pan American’s $14.3B.

Investors are still lumping First Majestic (NYSE:AG) (TSX:AG) in with the juniors, but the numbers say otherwise. Pan American is steady. First Majestic is scaling.

This isn’t about hype. It’s about math.

AG’s AISC came in at under $21 in Q3 2025, while First Majestic realized an average selling price of $39 per ounce of silver. That’s a 47% margin… with all infrastructure already in place.

No major capex. No dilution. No waiting.

The ounces are flowing now. And now the silver price is sitting above $48.

The margins are widening now.

And the market still hasn’t caught up.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) could be sitting on one of the most asymmetric setups in the entire commodity space.

And institutional investors are starting to notice.

The Smart Money Is Already Here Quietly Positioning While AG Trades at a Discount

If the valuation gap wasn’t compelling enough…

The ownership roster should seal the deal.

Because First Majestic Silver (NYSE:AG) (TSX:AG) isn’t just operating in one of the most profitable windows we’ve seen in a decade, it’s doing so with deep institutional backing you rarely find in the mid-cap resource space.

As of Q3 2025, over 350 institutions now hold positions in First Majestic Silver (NYSE:AG) (TSX:AG),39 including some of the largest resource-focused funds on the planet.

These include:

- VanEck International Investors: One of the biggest players in metals and mining ETFs, with tens of millions in AG

- Sprott: Renowned for its deep focus on precious metals; increased its stake as silver moved toward $30

- Vanguard: Maintains a significant position, suggesting broader institutional comfort even among passive giants

- JPMorgan: Recently filed a new position, a possible signal of growing confidence in AG’s near-term prospects

And that’s just the public filings.

Behind the scenes, First Majestic Silver Corp. (NYSE:AG) (TSX:AG) continues to show up across hedge fund holdings, commodity newsletters, and institutional mining decks, a sign that this isn’t just a retail-fueled story.

The market may not have priced it in yet…

But the professionals? They’re already here.

They see what’s coming.

A tightening silver market.

A producer with scale, tech, and margin.

And a valuation gap that gets harder to ignore with every uptick in spot.

So what’s next?

First Majestic Silver (NYSE:AG) (TSX:AG) may not just be a good silver stock…

It could be the silver stock of this cycle.

Final Thought: This Isn’t a Junior Exploration Bet. It’s a Fully Operating Silver Machine… Hiding in Plain Sight.

The price of silver is already breaking out.

Global demand is surging from green energy, EVs, solar, and industrial AI infrastructure. Tariffs have added a new layer of pressure. Supply is getting squeezed.

And while other names are still drilling and dreaming…

First Majestic Silver (NYSE:AG) (TSX:AG) is on track to produce 30.6 to 32.6 Moz AgEq in 2025 across four active mines, with advanced tech, significant gold byproduct credits, and margins that expand as silver climbs.

They’ve got:

- Institutional buy-in

- Founder-led alignment

- AISC well below current spot

- And a portfolio that’s built, not theoretical

AG isn’t a long shot, it’s a mispriced asset in a sector facing an accelerating squeeze.

And that window won’t stay open for long.

Want the Full Story?

Subscribers to The Trading Whisperer get access to our complete investor breakdown, including:

✔️ A downloadable copy of First Majestic’s latest corporate deck

✔️ Real-time trade ideas and alerts from our desk

✔️ Ongoing coverage of silver catalysts as the bull run accelerates

The next leg of this silver move could be fast and steep.

Don’t watch it from the sidelines.

👉 Subscribe now to The Trading Whisperer and position yourself before the rest of the market catches up.

*all figures are in USD unless otherwise specified