Every bull market begins with a shift that most people overlook.

For lithium, that shift came in late September when Beijing quietly issued one of the most aggressive energy storage mandates in history.1

The new plan called for 180 gigawatts of grid-scale battery storage by 2027, roughly double current levels. It was a technical policy on paper, but its impact was immediate and global.2

Within days, lithium futures on the Guangzhou exchange jumped. Spot prices climbed for five consecutive sessions. Inventories began to thin as converters scrambled to secure feedstock.3

The signal was unmistakable.

China had moved from stimulus talk to procurement policy. And in doing so, it reignited the entire lithium market.

What many investors fail to realize is that this time, the story extends far beyond electric vehicles.

The demand now coming online is structural. It powers the backbone of modern civilization: AI data centers, renewable grids, industrial backup systems, and national energy infrastructure.

These aren’t cyclical purchases. They are permanent fixtures of the energy transition.

And that’s why Atlas Lithium Corp. (NASDAQ:ATLX) stands out.

The New Epicenter: Brazil’s Lithium Valley

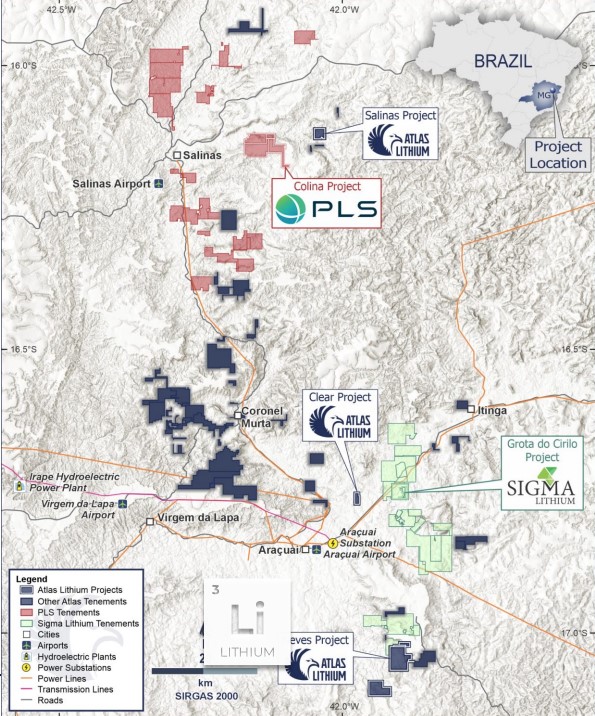

While most of the market’s attention still revolves around Australia and North America, the real supply opportunity is emerging in Brazil, specifically in Minas Gerais, a region now known as Lithium Valley.

This area isn’t theory. It’s operational. Concentrate is already being produced and shipped to China’s converter network.

Infrastructure is in place. Labor is local. Roads are paved. Ports are accessible.

In 2024, roughly 99% of Brazil’s lithium exports went directly to China,4 confirming its importance as a clean and efficient supply route into Asia’s battery ecosystem.

And in this same district, Atlas Lithium Corp. (NASDAQ:ATLX) controls one of the most advanced development-stage projects in the country — one that already has key operational permits approved, feasibility study complete, and a $30M modular processing plant built, paid for, and delivered on site.5

That level of readiness sets it apart.

What Readiness Looks Like

Many juniors are still at the exploration or early study phase. Atlas Lithium has already advanced beyond that.

Atlas Lithium’s (NASDAQ:ATLX) Definitive Feasibility Study (DFS), completed by SGS Canada, outlined a 145% internal rate of return (IRR), an after-tax NPV of $539 million, and a payback period of approximately 11 months from the start of operations.7

Capital costs were estimated at just $57.6 million, making Neves one of the lowest-capital-intensity lithium projects in Latin America.

Those numbers are paired with real-world progress.

The project’s $30M modular dense media separation (DMS) plant is already constructed, shipped, and sitting in Brazil, ready for final assembly. That eliminates months of logistics uncertainty and confirms Atlas Lithium’s ability to move quickly when market conditions align.

The company received its key operational permits from the state of Minas Gerais after a fourteen-month review. This green light allows mining, construction, and processing activity to commence.

Together, these steps position Atlas Lithium Corp. (NASDAQ:ATLX) as a developer that has already cleared most of the technical and regulatory barriers others still face.

Press Releases

- Atlas Lithium Subsidiary’s Iron Quadrangle Project on Track for Q4 2025 Revenues

- Atlas Lithium’s Critical Minerals Subsidiary Delivers Exceptional Rare Earths Grades and Premium Graphite Concentrate in Initial Reporting

- Atlas Lithium Reports Excellent Exploration Progress at 100%-Owned Salinas Project

- Atlas Lithium’s Neves Project Completes Definitive Feasibility Study Estimating 145% IRR and 11-Month Payback

- Atlas Lithium’s Critical Minerals Subsidiary Reports Strong Rare Earths, Titanium, and Graphite Results

Strategic Capital and Global Validation

When institutional partners commit to a development story, it sends a clear message that real diligence has been done.

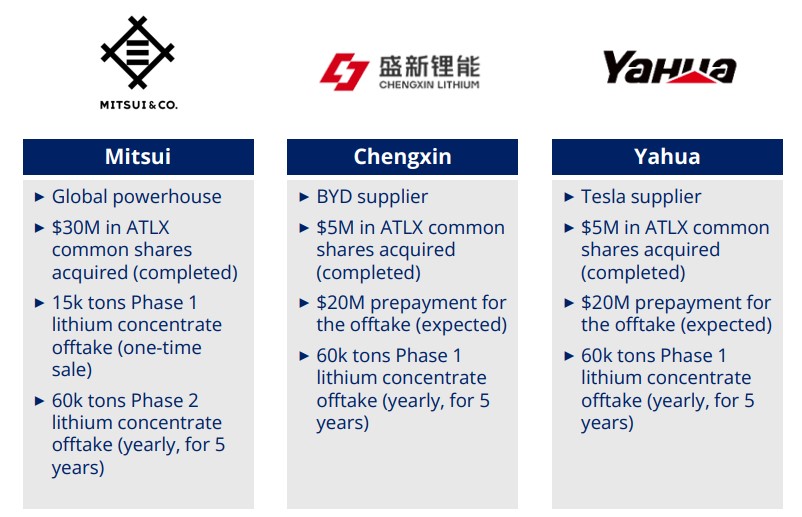

Atlas Lithium Corp. (NASDAQ:ATLX) attracted one of the most credible groups of backers in the industry.

A Japanese trading powerhouse, Mitsui & Co., invested $30 million at a 10% premium, securing long-term offtake rights.8

Two leading Chinese battery-material producers, Yahua Industrial Group and Chengxin Lithium Group, added a combined $10 million in equity and $40 million in committed non-dilutive offtake prepayment tied directly to future concentrate sales.9

These companies don’t speculate. They supply Tesla, BYD, and other global OEMs. Their participation signals confidence in the quality and scalability of Atlas Lithium’s assets.

In total, $80 million has already been committed to Atlas Lithium Corp. (NASDAQ:ATLX) in equity investments and non-dilutive offtake commitments by sophisticated Tier 1 global companies, a validation most early-stage developers never achieve.

Analyst Coverage and Institutional Interest

Two independent research firms currently cover Atlas Lithium Corp. (NASDAQ:ATLX), both with Buy recommendations:10

- H.C. Wainwright & Co., a leading natural resources investment bank, highlights Atlas’s strong project economics and tight share structure as key differentiators.

- A US-based mining research group also issued a Buy rating, citing the company’s advanced readiness and alignment with top-tier partners.

Institutional investors have followed suit. Holdings have been disclosed from Citadel, Invesco, Susquehanna, RBC, and Marshall Wace, funds known for taking early positions in resource names with asymmetric upside potential.11

This is the kind of institutional footprint that often precedes broader market recognition.

Neighborhood Advantage

Geography matters in mining, and location inside Lithium Valley is a built-in advantage.

Atlas Lithium (NASDAQ:ATLX) holds the largest lithium exploration portfolio in the region, with 557 km² of mineral rights, which is almost three times the size of Sigma Lithium’s land position.12

Its Clear Project sits less than four miles from Sigma Lithium’s operating mine, which currently anchors the district and commands a market capitalization around US$700 million.

To the east, Pilbara Minerals entered the same region through its $370 million acquisition of Latin Resources’ Colina deposit.13

These transactions establish clear benchmarks for how Brazil’s lithium assets are valued.

Atlas Lithium’s comparable resource, completed DFS, permits, and existing infrastructure suggest it’s positioned in the same league, yet it currently trades at a market capitalization near $100 million.

That disconnect defines the opportunity.

Why Timing Matters Now

Every cycle offers a brief window when fundamentals have shifted, but valuations have not yet caught up.

This appears to be that window.

Lithium prices are rebounding. Policy in China has converted into real purchasing. Brazil’s role as a reliable supplier has solidified.

Meanwhile, Atlas Lithium Corp. (NASDAQ:ATLX) stands as one of the few names in the sector that already holds the key permits, plant, and partnerships to scale when demand accelerates.

There is no guarantee of timing, and no forecast is implied. What stands out is the readiness relative to peers. In a sector where many are still years away from construction, Atlas Lithium has already completed the foundational steps.

That is as early as an investor can get at this stage.

The Bottom Line

Atlas Lithium Corp. (NASDAQ:ATLX) represents a clear asymmetry between execution and valuation:14

- A completed DFS with robust economics.

- A permitted, construction-ready project.

- A modular plant already in Brazil.

- $80 million in strategic funding and offtake commitments.

- Analyst Buy recommendations and institutional ownership from globally recognized funds.

All of this is taking shape inside a proven lithium-producing district, underpinned by global demand that’s only accelerating.

This is not the beginning of the lithium story, it’s the reacceleration.

This is our number one lithium trade idea right now. It is as early as one can reasonably get, with the groundwork complete and validation already in place. If restocking continues and development progresses as outlined, Atlas Lithium could emerge as one of the next major producers in Brazil’s Lithium Valley.

Download the corporate presentation now to see why Atlas Lithoum (NASDAQ:ATLX) is positioned at the center of the next phase of global lithium growth.