For nearly two years, the lithium market has been searching for direction. Prices slipped from their 2022 highs,1 developers paused spending, and traders began to assume the story had run its course.

Then Beijing flipped the switch.

In September, China rolled out an aggressive $35 billion action plan to expand grid-scale energy storage.2 The batteries that keep renewable power steady and the lights on in data centers.

Overnight, futures on the Guangzhou exchange began to climb. Spot prices followed.

Five consecutive sessions of gains later, lithium was back at a two-month high.3

The catalyst wasn’t a single headline.

It was the government’s plan to more than double new-type energy-storage capacity to roughly 180 gigawatts by 2027, with new compensation rules that make sure enough storage is built to meet peak demand.4 The result is a surge of new orders for the metals that make those batteries work.

That wave doesn’t stop at China’s border.

Brazil ships the majority of its lithium concentrate to Chinese converters, the first link in the chain that feeds those storage systems. When inventories shrink and factories start restocking, Brazilian feedstock is the material that clears first.

For traders watching this market, that’s the signal that matters. A clear connection between policy, physical demand, and price.

The tape has already responded. Port stockpiles are thinning, converters are bidding up deliveries, and developers that can supply reliable concentrate are back in focus.

In a market where policy has turned into procurement, readiness beats speculation. The projects that already have their engineering complete, key permits granted, and equipment paid for are positioned to benefit first.

When capital starts moving ahead of the crowd, it’s the clearest signal that the work on the ground has been noticed.

Mitsui committed $30 million at a premium. Yahua and Chengxin added $5 million each, alongside their commitment for a $40 million non-dilutive prepayment facility tied to offtake.

That is diligence turning into dollars, and it is the kind of alignment buyers look for when the market tightens.

One company in Brazil’s Lithium Valley fits that description precisely. That company is Atlas Lithium Corp. (NASDAQ:ATLX).

With a completed Definitive Feasibility Study, strategic partnerships with BYD and Tesla suppliers who committed $50 million to Atlas, and a large stake in a revenue-generating critical minerals producer, Atlas is positioned where readiness meets demand.

Policy Is Rewriting Lithium’s Value Chain

China is no longer tip-toeing around energy storage. It has spelled out a roadmap that will reshape demand for battery raw materials and Brazil sits directly in the feed line.

In September 2025, China unveiled its “Special Action Plan for Large-Scale New Energy Storage (2025-2027)” which set a target of 180 GW of installed grid-scale battery systems by end-2027.5 That target looms large for lithium developers because storage factories won’t run without predictable supply chains.

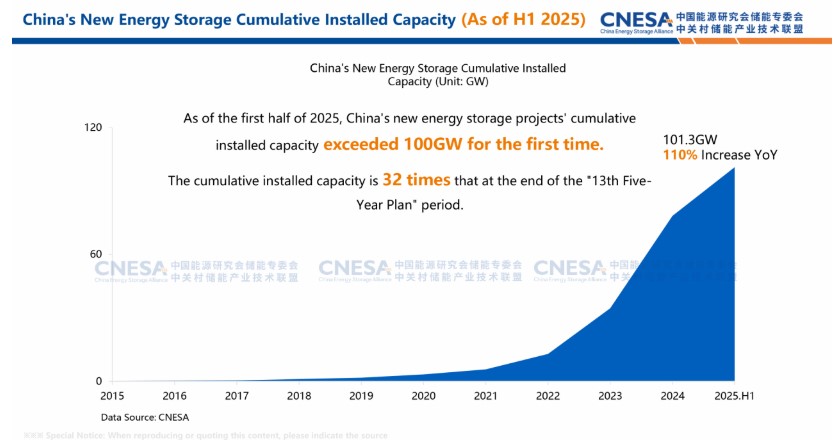

By mid-2025, the China Energy Storage Alliance reported roughly 164 GW of total energy-storage capacity, including over 100 GW of next-generation battery storage.

That rapid build-out isn’t a forecast, it’s proof that Beijing’s policy has shifted from planning to full-scale execution, locking in lithium demand across the grid and data-center sectors.

But there’s more than just build-out.

China’s recently announced export controls show a tightening hand on battery and lithium-ion component flows, especially high-performance cells, cathode materials, and anode precursors.6

When a country that processes over 60% of the world’s lithium and battery components begins to tighten access, the ripple effects hit global supply chains hard.7

In that context, Brazil’s role becomes pivotal. Brazilian lithium concentrate already feeds China’s converter network, giving the country a front-row seat in the new trade route linking policy to physical demand.8

For Atlas Lithium Corp. (NASDAQ:ATLX) that shift is not theoretical, it’s an immediate tailwind.

As Chinese buyers deepen ties with Brazil to secure concentrate and offset tightening supply at home, Atlas sits directly in the corridor those buyers now depend on.

Atlas is developing one of Brazil’s most advanced hard-rock lithium projects, positioned at the heart of this global pivot.

Atlas Lithium already holds the key permits for its flagship Neves Project,9 has a completed Definitive Feasibility Study (DFS) with strong economics, and a paid-for modular plant on the ground.

That means it doesn’t need a long “ramp” story, it’s ready to move when policy becomes purchase orders.

In a market where governments are turning mandates into purchase orders, Atlas Lithium Corp. (NASDAQ:ATLX) is positioned to deliver quickly.

Press Releases

- Atlas Lithium Subsidiary’s Iron Quadrangle Project on Track for Q4 2025 Revenues

- Atlas Lithium’s Critical Minerals Subsidiary Delivers Exceptional Rare Earths Grades and Premium Graphite Concentrate in Initial Reporting

- Atlas Lithium Reports Excellent Exploration Progress at 100%-Owned Salinas Project

- Atlas Lithium’s Neves Project Completes Definitive Feasibility Study Estimating 145% IRR and 11-Month Payback

- Atlas Lithium’s Critical Minerals Subsidiary Reports Strong Rare Earths, Titanium, and Graphite Results

Top 8 Reasons

to Closely Watch Atlas Lithium (NASDAQ:ATLX)

1

Policy Becomes Demand, Demand Becomes Price: China’s energy-storage drive has pushed lithium higher, with the most-active carbonate contract and spot both firming as inventories thin. The plan targets about 180 GW of storage by 2027, which adds a second growth engine beside EVs. That backdrop matters for any development name pointed at China’s buyers.10

2

Brazil Sells Into the Market That’s Buying: In 2024, about 99% of Brazil’s lithium exports went to China and that China-bound pattern persisted into 2025. When Chinese converters restock, Brazilian concentrate often clears first across established routes. Atlas Lithium is developing in that corridor.11

3

Completed DFS With Robust Economics and Key Permits in Hand: ATLX’s Neves Project DFS estimates 145% IRR, $539 million after-tax NPV, and about 11 months payback, with key permits received. That is a rare combination at this stage and keeps the story focused on execution over speculation.12

4

The Plant is Paid For and in Brazil: The $30M modular DMS processing plant was built, shipped, and has arrived in Brazil. That cuts schedule and logistics risk and reinforces that this is a development story with real equipment on the ground.13

5

Blue-Chip Validation and Offtake: Mitsui invested $30 million at a 10% premium and secured offtake allocations. Public disclosures also show Chinese battery-materials groups supporting commercial pathways.14 The simple message for investors is that sophisticated buyers have done diligence and written checks.

6

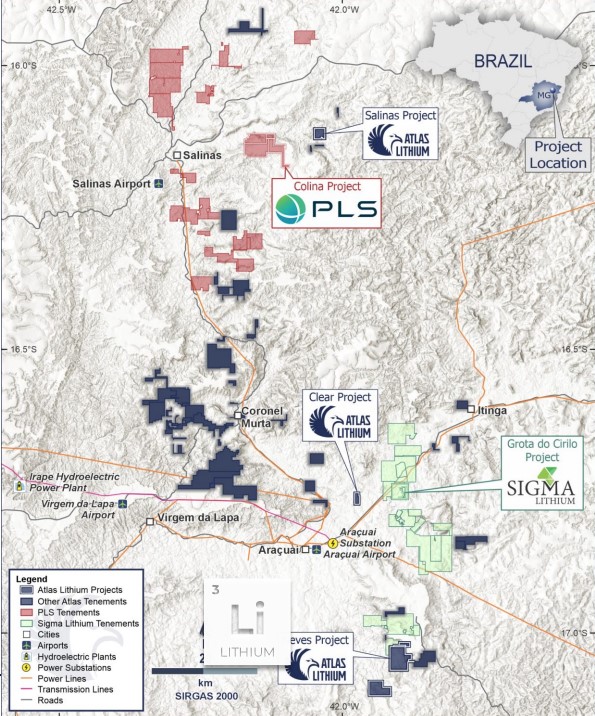

District Advantage in “Lithium Valley,” with Near-Neighbor Proof: Atlas Lithium’s Clear Project sits less than four miles from Sigma Lithium’s operating mine, and its Salinas Project lies only a few miles from Pilbara Minerals’ newly acquired Colina deposit. Sigma’s market value has hovered around $600–700 million in recent weeks, providing a live bellwether for how Brazil hard-rock capacity is priced.15

7

Scale Runway Beyond the First Pit: Atlas Lithium Corp. (NASDAQ:ATLX) cites the largest lithium exploration footprint in Brazil among publicly listed companies, creating room for a multi-hub future if exploration success continues. That portfolio depth can matter as lithium prices stabilize and offtake partners think in decks of years, not quarters.16

8

Optionality in Critical Minerals: Atlas Lithium owns ~28% of Atlas Critical Minerals (OTCQB:JUPGF), which expects Q4 2025 revenue from its Iron Quadrangle project and controls major Brazilian ground across rare earths, graphite, titanium and uranium.17 That gives ATLX exposure to non-lithium cash flow and strategic materials aligned with battery and defense supply chains.18

Four Miles From Sigma. Where Proximity Becomes A Pricing Edge.

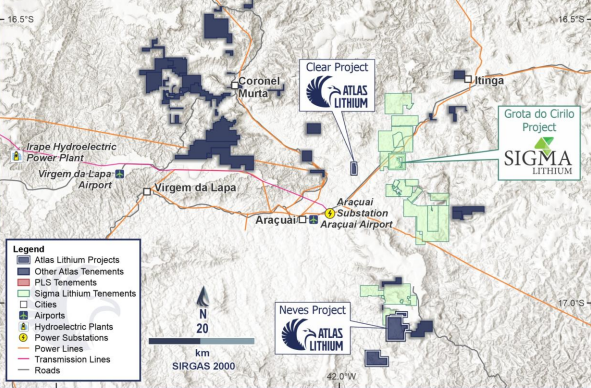

Minas Gerais, Brazil’s “Lithium Valley” is not theory on a slide. It is a working corridor where hard-rock lithium moves from pit to plant to port, then into China’s converter network.

Sigma Lithium (NASDAQ:SGML) operates here, setting the local benchmark for how Brazilian concentrate is produced, priced, and shipped out of Araçuaí and Itinga.19

Address matters when buyers are restocking.

Atlas Lithium Corp. (NASDAQ:ATLX) holds the largest lithium exploration portfolio in the same region, with 557 km² of lithium mineral rights, which is almost 3 times larger than Sigma Lithium’s holdings, providing substantial resource potential.

Atlas’ Clear Project sits less than four miles from Sigma’s mine, while its Salinas Project lies just five miles east of Colina, the deposit Pilbara Minerals bought for $370 million to secure its foothold in Brazil.20

Proximity is not a marketing line here. It is a logistics edge.21

Atlas Lithium’s (NASDAQ:ATLX) controls a district-scale position across this corridor, led by its permitted Neves Project with a completed DFS and a paid-for DMS plant already in-country. That infrastructure cuts schedule and shipping risk before the first tonne moves.

When customers in China increase orders, the shortest route is often to expand volumes on lanes that are already working.22

Brazil provides the rest of the equation: a stable democracy with deep mining expertise, paved export routes, and direct access to Asia.

In 2024, about 99% of Brazil’s lithium exports went to China, and that flow continued into 2025 as converters rebuilt inventories.23 For a development story positioned inside this corridor, the bridge from geology to customers is straightforward. Atlas Lithium Corp. (NASDAQ:ATLX) is built for that bridge.

Fastmarkets and S&P Global both describe Brazil’s potential as a low-cost hard-rock hub, with policy and investment pulling new supply through Minas Gerais. That’s the ecosystem a construction-ready developer wants to see.24

This is why location is a first-order variable in the current tape. China’s storage drive is adding a second demand engine beside electric vehicles. Brazil sells into that engine through routes that miners and traders already use.

Projects that can plug into those lanes without reinvention tend to get the first look when buyers move fast. Atlas Lithium Corp. (NASDAQ:ATLX) sits in that lane, in that district, with neighbors that prove how the system clears when policy turns into orders.

Let’s take a closer look:

Why the Valuation Gap Exists And Why It Matters Now

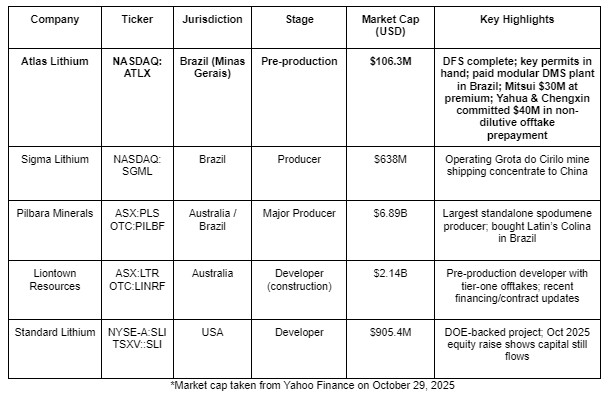

Across every metric, Atlas Lithium Corp. (NASDAQ:ATLX) trades at a discount that isn’t supported by the fundamentals.

The company’s current market cap sits near $106 million, compared to Sigma Lithium’s roughly $638 million, and Pilbara Minerals’ multibillion-dollar valuation.

Yet the company already shares the same structural advantages as larger producers, combining completed engineering, key permits, and long-term offtake agreements with global leaders in the battery materials sector.

Atlas has done what many developers are still promising. It has completed a Definitive Feasibility Study, secured all operating permits, and delivered a fully paid-for modular DMS processing plant to Brazil.

For investors, this mix of technical readiness and global partnership defines the opportunity. Atlas Lithium is already validated by industry leaders with the scale and expertise to move projects from construction to cash flow.

With the Neves Project moving toward production and Brazil emerging as a core supplier to the electric transition, the company’s valuation gap reflects timing, not fundamentals.

The market also underestimates Atlas Lithium’s ~28% equity stake in Atlas Critical Minerals (OTCQB:JUPGF), which is on track to begin revenue generation by late 2025.

Through this position, Atlas Lithium Corp. (NASDAQ:ATLX) gains exposure to Brazil’s growing rare earth and graphite industries: two materials now recognized as strategic under US and Chinese supply-chain policies. This holding adds another layer of tangible value and potential cash flow that is largely ignored in current valuations.

Neves: Transforming Lithium Production in Brazil’s New Battery Capital

Atlas Lithium’s (NASDAQ:ATLX) Neves Project stands at the center of a dramatic shift in global battery supply.

Situated in Brazil’s rapidly emerging Lithium Valley in Minas Gerais, Neves combines the rare ingredients every investor hopes for: scale, efficiency, speed to market, and the kind of regulatory clarity that supercharges value creation.

The ambition for Neves began years before the current lithium boom, with Atlas quietly assembling Brazil’s largest lithium mineral rights portfolio. Covering 557 square kilometers, Neves alone anchors a district that ensures Atlas Lithium owns the expansion runway for years to come.

Today, that vision is reality. Neves is now a permitted, construction-ready, hard-rock lithium project, a status few peers can claim.

One aspect that stands above all else is the superior capital efficiency and projected returns at Neves.

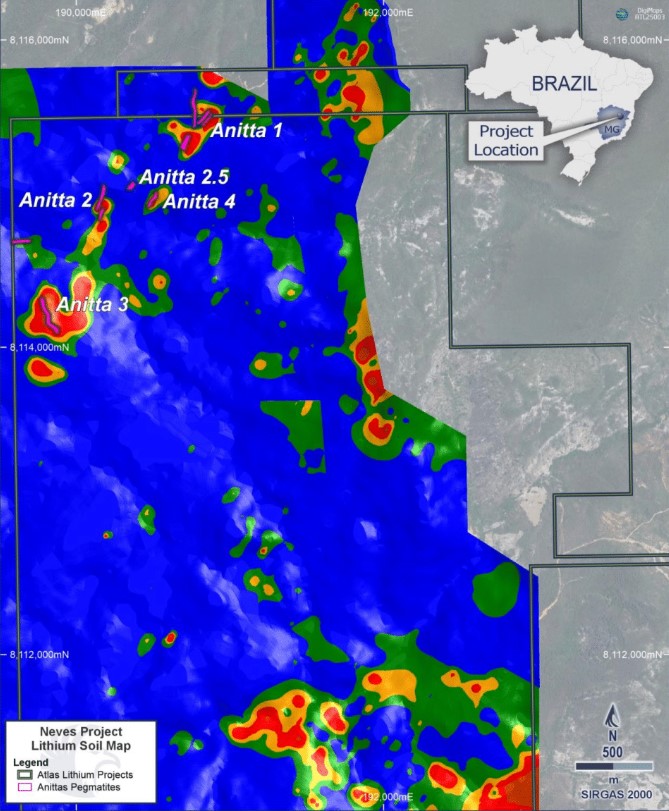

The project hosts proven open-pit reserves of 7.3 million tonnes grading 1.23% Li₂O, with near-surface mineralization and a low strip ratio that supports efficient and cost-effective mining.

The streamlined two-pit operation (Anitta 2 and Anitta 3), located just 1.5 kilometers apart, minimizes haulage costs and operational complexity.

Over its 6.5-year initial mine life, Neves is expected to produce approximately 951,000 tonnes of spodumene concentrate, positioning it among the lowest-cost operations in the region.

The DFS also highlights industry-leading economics: a 145% internal rate of return (IRR), an after-tax NPV of $539 million, direct capital costs of $57.6 million, and operating costs of just $489 per tonne of concentrate. The payback period is only 11 months from startup, confirming Neves as one of the most capital-efficient new lithium projects globally.

The payback period is a mere 11 months from the start of operations. Neves is engineered to output up to 150,000 tonnes of battery-grade spodumene per year, and could be expanded further if demand and market conditions warrant.25

Marc Fogassa emphasizes, “The DFS indicates potentially outstanding returns for our initial vision of developing a focused, near-term, profitable lithium production asset with minimal capital requirements. The combination of our low capital intensity and rapid payback period is expected to create exceptional value for our shareholders while positioning Atlas Lithium Corp. (NASDAQ:ATLX) to benefit from future organic expansion opportunities at Neves and other high-potential lithium areas that we own.”26

The company has already invested about $30 million to fabricate and transport its dense media separation (DMS) plant, which now sits in Brazil awaiting the final assembly. Ownership of such advanced infrastructure dramatically de-risks Neves, a point often overlooked by sector observers still focused on less-developed peers.

Permitting Advantage and Production Readiness

Obtaining the key permits for Neves was a rigorous, intensely scrutinized process. One of the final hurdles before entering the ranks of real lithium producers.

In October 2024, Atlas Lithium Corp. (NASDAQ:ATLX) achieved this milestone after 14 months of detailed review by the state of Minas Gerais and local authorities.27 The government’s unanimous approval signals both social and technical confidence in Neves.

“This milestone announcement is one of the most significant developments in Atlas Lithium’s (NASDAQ:ATLX) history,” said CEO Marc Fogassa, crediting the rigor of Brazil’s environmental agency and calling it “a key step for us towards becoming a lithium producer and advancing into the next phase of our growth trajectory.”28

The project can now mine one of its ore bodies, assemble and operate its lithium processing plant and sell lithium concentrate.

The DMS plant’s modular, state-of-the-art design brings advanced water recycling and sustainable tailings management to the operation.

In the words of James Schloffer, a lithium processing expert and company advisor, “Our lithium processing plant is engineered to possibly achieve the smallest environmental footprint in its class”.

De-risked Commercial Partnerships and Market Position

Atlas has done what many developers are still promising. It has completed a Definitive Feasibility Study, secured all key permits, and delivered a fully paid-for modular DMS processing plant to Brazil. Its partnerships add a layer of credibility and commercial depth that few peers can match.

Mitsui & Co., one of Japan’s largest trading houses backed by Warren Buffett’s Berkshire Hathaway and a major player in global battery supply chains, completed 18 months of due diligence before committing to $30 million at a 10% premium and secured long-term offtake rights for Neves production. This partnership provides both funding and market access through Mitsui’s established network across Asia and the Americas.

Two of China’s leading lithium processors, both deeply embedded in the EV supply chain, have also joined the roster.

Chengxin Lithium Group, a supplier to BYD, acquired $5 million in shares and committed to a $20 million non-dilutive prepayment facility tied to a five-year offtake of 60,000 tons per year.

Yahua Industrial Group, a supplier to Tesla, made a matching $5 million equity investment and a $20 million non-dilutive prepayment commitment for an identical offtake volume.

On top of that, insiders own over 26% of shares, aligning management incentives with shareholder value creation.29

Superior Geology and Long-Term Resource Potential

At its core, Neves is defined by exceptional geology. The flagship Anitta pegmatites contain large, near-surface spodumene crystals ideal for efficient, low-cost processing.

Over 90 mapped pegmatite outcrops across Atlas Lithium’s tenements leave significant room for future expansion, with multiple zones open along strike and at depth.

And Neves is designed not just for profit, but for responsible growth. Its dry-tailings system and advanced water recycling minimize environmental impact, while community partnerships in the Jequitinhonha Valley focus on local hiring and skills development.

The project represents modern mining—profitable, sustainable, and aligned with Brazil’s social priorities.30

Salinas: Atlas Lithium’s Next Growth Frontier

While Neves anchors Atlas Lithium’s (NASDAQ:ATLX) near-term production story, the company’s regional expansion underscores the depth of its platform in Brazil’s rapidly emerging Lithium Valley.

Atlas Lithium’s Salinas Project is emerging as the company’s next major growth opportunity in Brazil’s Lithium Valley, strategically situated just five miles east of the Colina deposit—a location that recently made headlines with Pilbara Minerals’ $370 million acquisition of Latin Resources.

It’s precisely this proximity to “deal-making” land that underscores Salinas’ importance for Atlas Lithium Corp. (NASDAQ:ATLX) shareholders and forward-looking investors.

Spanning 388 hectares in northern Minas Gerais, Salinas stands out for its remarkable early results.

Early exploration has been fast and disciplined: systematic mapping, LIDAR, soil sampling, and geophysical work have outlined multiple spodumene-bearing pegmatites.

The initial three drill holes intercepted high-grade lithium, confirming continuous mineralization at shallow depths, with assays exceeding 2% Li₂O from core samples analyzed by SGS.31

With over 501 meters of diamond drilling completed and pegmatite continuity confirmed, Salinas mirrors many of the advantages that make Neves so valuable: shallow mineralization, cost-effective open-pit potential, and strong infrastructure nearby.

Atlas Lithium’s (NASDAQ:ATLX) technical team continues to expand the exploration footprint, with soil geochemistry and geophysical studies identifying several additional lithium anomalies linked to newly mapped pegmatites.

Salinas is now positioned to move from promising exploration to advanced assessment, primed to become one of Atlas’s next production candidates, and a key driver of long-term value in global lithium supply.

Clear Project: Expansion Optionality in Lithium Valley

Just a few miles away, Atlas’s Clear Project strengthens that regional framework.

Situated less than four miles from Sigma Lithium’s operating mine, Clear benefits from direct access to established roads, power lines, and an experienced local workforce.

The project spans a 470-acre footprint and has already returned promising results from soil sampling, drone mapping, and magnetic geophysical surveys, which highlight multiple parallel pegmatite zones trending northeast-southwest, the same orientation as nearby producing deposits.

Atlas Lithium’s (NASDAQ:ATLX) exploration at Clear is guided by the same rigorous standards that de-risked Neves and Salinas.33

Taken together, Salinas and Clear showcase Atlas Lithium’s ability to build value across a connected, high-potential district. They extend the company’s growth horizon beyond Neves, offering scale, optionality, and proximity to proven deposits that continue to attract top-tier buyers.

As Neves advances toward production, these regional assets ensure that Atlas Lithium’s (NASDAQ:ATLX) story remains one of sustained growth. Not a single-asset success, but a multi-asset platform driving Brazil’s rise as the world’s newest lithium powerhouse.

The Capital Structure and the Strength Behind the Stock

The balance sheet tells the story of how much work has already been done. Atlas Lithium Corp. (NASDAQ:ATLX) is structured tightly, with fewer than 24M shares outstanding and a modest market capitalization relative to the scale of its flagship project. That combination of limited dilution, institutional ownership, and strategic capital makes this one of the leaner development stories in the lithium sector.

Key Stock Highlights

Share Price: $5.22 (Oct 27, 2025)

Shares Outstanding (basic): 23,514,880

Market Capitalization: ~$107 million

52-Week Range: $3.54 – $11.89

The company trades on the NASDAQ under the symbol ATLX and remains one of the few pure-play lithium developers from Latin America accessible to US investors. The float is compact, and insider and strategic holdings together account for a meaningful percentage of the book, limiting dilution while maintaining alignment with shareholders.

Analyst Coverage

Two independent analysts currently follow Atlas Lithium Corp. (NASDAQ:ATLX), both maintaining Buy recommendations:34

- Jake Sekelsky from a US mining research firm known for its small-cap metals coverage.

- Heiko F. Ihle of H.C. Wainwright & Co., a leading US investment bank focused on natural resources.

Their research highlights the company’s project readiness, capital efficiency, and partnership structure as core strengths without relying on speculative production timelines.

Institutional Holders

Institutional ownership is unusually broad for a development-stage miner. Reported holders include Mitsui & Co., UBS, Citadel, Invesco, SIG Susquehanna, ExodusPoint, Marshall Wace, and RBC. Filings show that several of these funds have maintained or increased positions through 2025, underscoring confidence in the company’s execution path.

Strategic Partnerships and Cornerstone Investment

The shareholder list reads like a cross-section of the global battery supply chain.

- Mitsui & Co., Ltd. invested $30 million at a 10% premium, following 18 months of due diligence, and secured a multi-year offtake agreement. The position represents significant ownership and establishes Mitsui as a cornerstone shareholder.

- Chengxin Lithium Group and Yahua Industrial Group, both Tier-1 Chinese battery-material suppliers that count BYD and Tesla among their downstream customers, jointly committed $50 million. The package includes $10 million in equity investment already received and a $40 million non-dilutive offtake prepayment commitment, providing near-term funding directly from the future buyers of the product.

Together these partnerships align Atlas Lithium Corp. (NASDAQ:ATLX) with both the trading and industrial sides of the lithium market. They represent due diligence, logistics expertise, and long-term offtake demand from entities that already operate deep inside the global battery supply chain.

The result is a capital structure that looks more like a mid-tier producer than a junior. It is tight, institutionally held, and validated by partners with direct exposure to where the demand resides. That mix of strategic equity, industrial prepayments, and limited dilution forms the foundation for the next stage of growth as the Neves Project and its satellite properties advance.

Proven Management Team with Deep Lithium Expertise

Every development story eventually comes down to people — the ones who assemble the ground, win the key permits, attract the capital, and keep the plan moving when the cycle turns. Atlas Lithium Corp. (NASDAQ:ATLX) has that core in place. Its leadership combines capital-markets experience, technical credibility, and the on-the-ground knowledge required to advance a project from maps to concentrate.

Together, they have already accomplished what most juniors spend years pursuing. A permitted project, institutional investment, and validation from blue-chip partners. Their next task is simple: execute. Turn Neves and their other projects into producing assets and extend Brazil’s Lithium Valley onto the world stage.

The Window Is Open. Execution Will Decide Who Wins.

Policy has turned into orders. Orders are turning into price. Brazil is moving material through the lanes that China is restocking, and the names that prepared during the downcycle now have the cleanest path to cash flow. The difference shows up in permits, plants, partners, and a district that already ships concentrate on schedule.

This is the setup that serious investors look for. A flagship with a completed feasibility study. A modular plant paid for and in the country. A key permit that lets steel and crews get to work. Capital and offtake aligned with counterparties who live inside the battery supply chain.

In that environment, the market begins to separate what is ready from what still needs to promise. Atlas Lithium Corp. (NASDAQ:ATLX) sits on the ready side of that divide.

If you want the full picture, get the facts from the source. The latest deck lays out Neves, the satellite projects, the cost profile, and the capital structure in detail. It is the kind of document you read before the next policy headline hits the tape and shifts pricing across the basket.

Subscribe to access the corporate presentation now.

You will get the full investor deck, project maps, and the most recent company disclosures in one download. Then decide how Atlas Lithium Corp. (NASDAQ:ATLX) fits on your watchlist as storage demand stacks on top of EV demand and Brazil continues to supply the buyers who are paying.

*All figures in US dollars unless otherwise indicated.