For decades, if you wanted access to the world’s most powerful drugs, there was no choice.

You took a pill the size of a marble… or you endured a needle.

That’s it.

No alternatives.

But here’s the shocking truth Big Pharma doesn’t like to admit: those methods are outdated, inefficient, and in many cases dangerous.

Pills often deliver only a fraction of the medicine to your bloodstream. The rest is wasted or broken down in your gut.

Needles terrify patients, limit compliance, and expose people to risks they don’t need to take.

And yet, these old methods still generate billions for the drug giants.

That’s why what I’m about to share with you is so important.

A small clinical-stage company has discovered a way around the old model.

They don’t invent new drugs. They reinvent how proven drugs are delivered.

Imagine a simple strip that dissolves under your tongue.

No needle. No swallowing. No fear.

Designed for rapid absorption through the mouth, which can enable faster onset and reduce first-pass loss vs some pills.

Patients love it. Doctors want it. Big Pharma needs it.

And here’s where things get urgent.

One of Merck’s biggest moneymakers is Mavenclad, a pill used to treat multiple sclerosis.

It generates over $1 billion in annual sales,1 with each treatment costing patients a whopping $60,000 – 90,000 annually.

But here’s the catch. Merck’s patents on Mavenclad will start to expire in 2026.2

And this is where the loophole comes in.

The small company I’m talking about already owns the rights to a new patent on cladribine, the same powerful drug in Mavenclad, only their version is a needle-free strip that dissolves on the tongue.

Their patent could run until the 2040s.3

The opportunity is enormous. Billions are at stake. And almost no one in North America is talking about it yet.

That company is BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF). And their story could rewrite the future of medicine.

A Simple Strip That Could Replace Needles and Pills

The solution is not another pill.

It is not another painful injection.

It is a small dissolvable strip that goes under your tongue.

It melts in seconds. The drug moves straight into your blood through the mouth. That can mean faster onset and less waste than a standard pill.4

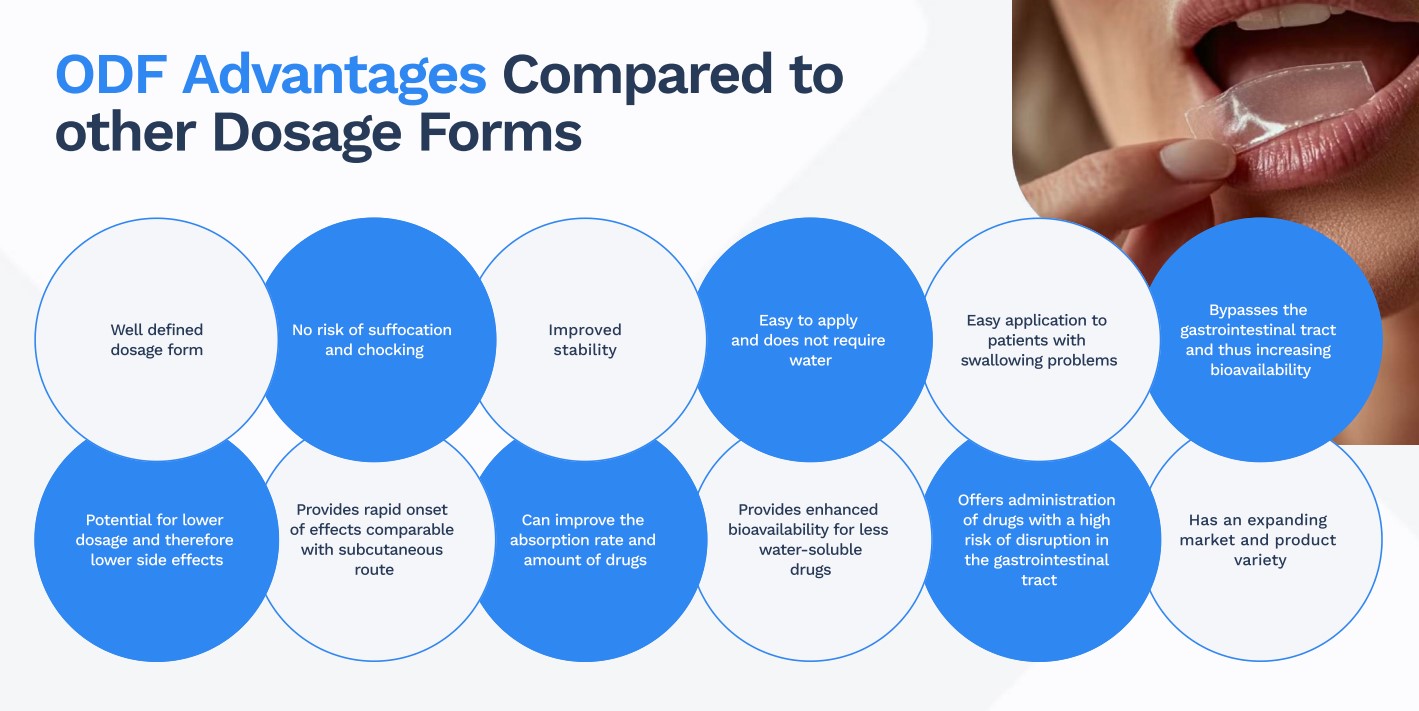

No swallowing. No fear of needles. Less medicine lost in the gut. Reviews of oral thin films show rapid absorption and the chance to bypass first pass metabolism, which can improve how much drug your body actually uses.5

This is the breakthrough at the heart of BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF).

And it can change how some of the best selling drugs reach patients, starting with diseases that need easier delivery.

Press Releases

- BioNxt Launches 15-day Sublingual MS Therapy Dosing Optimization Study in Preparation for Human Bioequivalence Study

- BioNxt Reports Sublingual Multiple Sclerosis Drug Milestones Including Large-Animal Study for Validation and Dosing Optimization

- BioNxt Advances Oral Dissolvable Film (ODF) Program with Successful Proof-of-Concept and Prototype Development

- BioNxt Solutions Completes Up-Listing to The OTCQB Market

- API Delivery Enables Start of Lab-Scale ODF Development at BioNxt

Here is why this matters.

Pills often break down before the drug reaches the blood. Needles add fear and cost. Thin films are designed to dissolve fast and reach the blood through the mouth. That is why researchers call them fast acting and patient friendly.7

Now think about the markets this can touch.

Multiple sclerosis affects about 2.9 million people worldwide.8 Many patients struggle to swallow. Meta analyses show about 43% of people with MS have problems swallowing.9

A medicine that does not require a swallow is a clear win for comfort and for adherence.

Merck’s MS pill Mavenclad reached blockbuster status, crossing the $1 billion a year mark.10 That tells you how large this market is.

BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) is advancing a fast-dissolving cladribine strip designed to tackle MS and other autoimmune diseases. The company has already hit key milestones and is now gearing up for human testing.11

With human testing on the horizon, the opportunity goes far beyond MS to autoimmune disorders like myasthenia gravis and rheumatoid arthritis, each representing multi-billion-dollar markets.

By bringing oral thin films into these spaces, BioNxt is positioning itself to simplify treatment and improve patient adherence.12

Then look at diabetes and obesity. Analysts now project the GLP-1 category could reach $150 billion this decade on the strength of blockbusters like Ozempic and Wegovy.13 The trend is global and growing.

BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) is stepping directly into this trend with a semaglutide thin film program. The company has already proven the concept at the prototype stage.14

The goal is clear: a needle-free format that is easy to take and simple to distribute worldwide.

And it doesn’t stop there. Cancer care is one of the largest and most urgent markets, with global spending on oncology drugs measured in the hundreds of billions of dollars.

Thin films and targeted delivery can help concentrate medicine where it is needed most and reduce harmful spillover. That is the vision driving BioNxt’s targeted chemotherapy platform and its ongoing film development.

Here is the key difference. Most small biotechs gamble on a single experimental drug.

BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) is building multiple programs on a proven delivery platform.

The pipeline already spans a cladribine strip for MS,15 an immunosuppressant strip for autoimmune disease, semaglutide thin films for diabetes and obesity.16 The company also envisions expansion into additional therapeutic areas via platform licensing.

That means investors get more than one chance at a major outcome.

And it all comes back to one simple idea: a tiny strip that melts on the tongue and gets medicine where it needs to go.17

The Top 8 Reasons

BioNxt Could Be The Next Big Thing in Biotech

1

Billions Up for Grabs: One of the leading treatments for multiple sclerosis has already reached over $1 billion in annual sales.18 That shows the size of just one of the markets BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) is targeting with its new oral film technology.19

2

Needle Free Innovation: BioNxt’s delivery system is a tiny strip that dissolves under the tongue. It offers faster absorption, easier use, and less fear compared to pills or injections.

3

Lower-Risk Model: Instead of inventing brand new drugs, BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) reformulates proven therapies in new delivery formats. This means clinical studies are faster, cheaper, and more predictable, often taking weeks instead of years.

4

Multiple Billion Dollar Markets: Beyond multiple sclerosis, BioNxt Solutions (CSE:BNXT) (OTCQB:BNXTF) is advancing oral film solutions for autoimmune conditions such as myasthenia gravis and rheumatoid arthritis. Each represents a multi-billion-dollar global opportunity with the global market at $28 billion in 2021, projected to reach $41 billion by 2033.20

5

Riding the Metabolic Health Boom: Analysts project the global market for diabetes and weight management treatments will reach $150 billion by 2030.21 BioNxt has already built a proof of concept thin film prototype in this fast growing sector.

6

Cancer Care Potential: The global oncology drug market exceeds $217 billion annually and is projected to grow to over $360 billion in 2034.22 BioNxt is advancing a targeted chemotherapy platform that could reduce side effects and focus drug delivery directly on tumors.

7

Patent Fortress: BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) has already secured a broad umbrella patent in Europe and Eurasia, with filings underway in the United States, Canada, Japan, and other major regions. These filings create long term barriers to entry with the patents not expiring until the 2040s.23,24,25

8

Undervalued Underdog: Many biotech peers with just one experimental program trade at several hundred million dollars. BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) has multiple programs across billion dollar markets yet trades at a fraction of that value.

A Simple Strip Could Potentially Unlock Billions in Healthcare Profits

Every so often, a company emerges with a story that feels more like a movie than a corporate presentation. BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) is one of those rare cases.

This is not another biotech chasing a decade-long science experiment.

This is a lean company with provisional patents in hand, trials about to begin, and billion-dollar markets in sight.

And it all started in the middle of a war.

From Crisis to Breakthrough

When Russia invaded Ukraine, a respected oncologist lost everything. His lab. His factory. His years of research in chemotherapy.26

Instead of walking away, he looked for a partner. And he found BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF).

Together, they began working on a new way to deliver medicine. Not another pill. Not another needle. A simple oral film that dissolves on the tongue and delivers proven drugs more efficiently than ever before.

This unlikely partnership gave BioNxt something priceless. Direct expertise in cancer therapies. Real world experience in oncology. And the vision to take existing billion-dollar drugs and reinvent how they reach patients.

At the same time, BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) established a German R&D hub with deep knowledge of thin film drug delivery. This team became the engine behind the company’s new pipeline. A group of scientists who know how to design films that dissolve in seconds and get medicine into the bloodstream faster than a pill ever could.

In January 2025, BioNxt advanced its strategy by relocating to Gen-Plus’s state-of-the-art Munich facility, unlocking speed, scale, and sharper IP for drug-delivery programs.

While most biotech firms balloon with dozens or even hundreds of employees, BioNxt stayed lean. Trials are outsourced. Overhead is kept to a minimum. The company focuses on what matters most: patents, product design, and execution.

Investors call this the scrappy underdog model. Small. Focused. Efficient. Positioned to punch above its weight.

Why Timing Could Not Be Better

The story alone would be compelling. But the timing makes it urgent.

Over the next few months, BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) expects national patents to be issued across the US, Canada, Australia, Japan, and Europe.27 Each approval extends its reach and builds a legal moat that competitors cannot easily cross.

“Patents are the currency of biotech.”

Patents are the currency of biotech. And BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) is about to cash in.

At the same time, the company is preparing for a human bioequivalence trial for its oral film in multiple sclerosis. Unlike traditional drug trials that last years and cost hundreds of millions, a bioequivalence study can deliver results in weeks.

The goal is simple: prove that BioNxt’s strip works just as effectively as the pill. No decade-long waits. No sky-high costs. Just clear data that could open the door to major markets.

And management has signaled something investors rarely hear: weekly news flow. In biotech, news drives attention. Attention drives trading. And steady catalysts can build momentum that feeds on itself.

Right now, the institutions are not heavily involved. BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) is still a small cap. But that window could potentially be closing. Once patents drop and trial data is published, the big funds could start circling quickly.

This is exactly when individual investors want to pay attention.

The Investment Case Investors Cannot Ignore

Here is the core reason this matters.

Most biotech companies gamble everything on one experimental drug. They spend a decade and hundreds of millions of dollars chasing approval. And most fail.

BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) does not play that game. The company reformulates drugs that already work into better delivery systems. That means:

- Lower risk.

- Faster studies.

- Cheaper development.

- And the same billion-dollar upside.

This is a biotech built to avoid the catastrophic downside.

Peers with a single drug in development often trade at several hundred million dollars in market value. BioNxt is still worth a fraction of that. Yet it has multiple billion-dollar markets on its roadmap.

Multiple sclerosis alone is a market measured in billions every year. Add in autoimmune conditions like myasthenia gravis and rheumatoid arthritis. Layer on diabetes and obesity, a sector forecast to hit $150 billion by the end of this decade. Then factor in the global oncology market, which already exceeds $200 billion.

Every one of these markets is in play for BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF). And the patents would stretch into the 2040s.28

If Big Pharma does not strike a deal, competitors likely will. The intellectual property alone is too valuable to ignore.

That is why this setup is so rare. BioNxt Solutions (CSE:BNXT) (OTCQB:BNXTF) is not just another biotech trying to prove a theory. It is a lean team with patents in motion, trials about to begin, and multiple billion-dollar opportunities lined up.

And all of this comes right before the biggest catalysts in its history.

Why Investors Are Paying Attention Now

It is simple.

- A powerful origin story that proves resilience.

- A lean team running one of the most efficient models in biotech.

- National patents expected to be issued in the coming months.

- A human trial that can deliver results in weeks.

- Weekly news flow to drive investor attention.

- Multiple programs across billion-dollar markets.

- Patents that last into the 2040s.

- And a market value that looks tiny compared to its peers.

That is the opportunity in front of investors today.

BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) is cheaper. Faster. Lower risk. And standing on the edge of multiple catalysts that could revalue the company in a very short time.

The clock is ticking.

Big Pharma’s Billion Dollar Problem

For decades, Big Pharma has controlled some of the most lucrative drug markets on earth. They lock down patents, charge staggering prices, and rake in billions every single year.

Take Merck. Their multiple sclerosis pill has become a billion dollar blockbuster. Sales topped $1 billion in 2023 alone.29 Year after year, it has been one of the company’s best performers.

But here is the catch.

Merck’s patent protection starts to run out next year.30

That means the moat that protected billions in revenue is about to vanish. The door will swing wide open for generic competition. Unless Merck or another player finds a way to extend their control.

And that is where BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) plans to come in.

BioNxt holds a new provisional patent on a tongue dissolving oral film version of the same active ingredient. As previously mentioned, their patent runs until the 2040s. BioNxt discovered the loophole Big Pharma missed.

Merck is not alone. Across the industry, patents are falling like dominoes:

- Humira, AbbVie’s best-selling autoimmune drug, generated more than $20 billion a year at its peak.31 Its US patent expired in 2023, and competitors rushed in with biosimilars.32 AbbVie has lost billions in sales almost overnight.

- Gleevec, Novartis’s cancer drug, once made nearly $5 billion annually.33 Its patent expired in 2016. Within a year, sales collapsed by 70%.34

- Zyprexa from Eli Lilly pulled in nearly $5 billion annually before going off patent.35 Once generics arrived, revenue fell off a cliff.36

This is the cycle of Big Pharma. Patents expire. Billions in revenue vanish.

But sometimes, a company finds a way to file a new patent on a new delivery system. And that can extend exclusivity for decades. It is one of the most powerful profit engines in biotech.

That is the strategy at the heart of BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF). Take billion dollar drugs. Reformulate them into oral films. File new patents. And keep the value flowing for another 20 years.

Most investors never hear about this strategy until it is too late. By then, the big players have already made their move.

Right now, BioNxt is still under the radar. But the patents are lining up. The trials are about to begin.

The Pipeline That Sets BioNxt Apart

Most small biotechs bet everything on one risky program. BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) is different.

It has a platform with multiple programs, each with near-term catalysts and long-term revenue potential.

- Oral Film for Multiple Sclerosis (MS): BioNxt’s flagship program. A human bioequivalence trial is on deck for late 2025 or early 2026, with results expected in weeks, not years. Patent coverage expected well into the 2040s.46

- Immunosuppressant Oral Film for Rheumatoid Arthritis (RA): A new oral film designed for rheumatoid arthritis. Currently advancing from formulation into preclinical testing, with a massive multi-billion-dollar market in sight.47

- Oral Film for Diabetes and Obesity: A semaglutide thin film built to tap into the red-hot GLP-1 market. A working prototype is already complete, and preclinical development is the next step.48

- Oral Films for Transplant and Oncology: Programs underway for solid organ transplant and cancer care. BioNxt’s mTOR and targeted chemotherapy films are designed to improve delivery where it matters most.49

- Targeted Chemotherapy Platform: A breakthrough drug delivery system aiming to concentrate chemo drugs at the tumor site while sparing healthy tissue. Advanced preclinical data is in hand, and partnering opportunities are expected as results mature.

- Anti-Aging and Longevity Programs: Early-stage work exploring semaglutide oral films for age-related conditions. This is a fast-growing sector projected to hit ~$93 billion by 2027.50

Revenue and Timeline

- Near term (6–12 months): National patents expected in major markets. Human bioequivalence study launch for the MS program.

- 2025–2026: Launch of the MS bioequivalence trial with results expected within weeks of completion. Immunosuppressant (RA) and metabolic health (semaglutide) programs advancing through preclinical development.

- 2026-2027: Patent expiry for competing MS treatment creates a market opening. BioNxt is positioned to capture share with its oral film.

- Longer term: Multiple programs advancing in parallel create potential for licensing deals and commercial revenues.

The Team Behind the Breakthrough

Every biotech story comes down to the people driving it.

And BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) has built a team that blends science, strategy, and execution.

And BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) has built a team that blends science, strategy, and execution.

At the top is Hugh Rogers, a corporate lawyer turned biotech entrepreneur. He has spent years building companies in healthcare and technology, and he knows how to take complex science and turn it into a business investors can understand.

Beside him is the Ukrainian oncologist who lost his lab in the war but brought his expertise in cancer therapies to BioNxt. His knowledge in chemotherapy delivery has helped shape the company’s targeted oncology program.

On the technical side, BioNxt runs a German R&D hub with a group of scientists who have decades of experience in thin-film drug delivery. They are the ones designing strips that dissolve in seconds and deliver medicine with precision.

Instead of building a bloated structure, BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) keeps its core team lean. The heavy lifting of trials is outsourced to specialized partners. This keeps costs low, timelines fast, and results focused.

It feels like the classic underdog setup. A small, sharp team going after billion-dollar markets with a smarter, cheaper model.

And that is exactly the kind of team investors like to back early.

The Door Is Open Today But It Will Not Stay Open Forever

Every major biotech story starts the same way.

Small company. Lean team. Breakthrough technology. Patents that Wall Street has not yet priced in.

That is exactly where BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) stands today.

Patents are pending in the world’s biggest markets.

A human bioequivalence trial is set to begin.

Weekly news flow is lined up.

And the company is still trading at a fraction of the value of its peers.

The share structure is tight. The float is limited. Institutions are not heavily involved yet, but they will not stay on the sidelines once patents and trial results are public.

This is the kind of setup investors rarely see twice.

If you missed the early days of AbbVie before Humira… or Novartis before Gleevec… you know how fast the window can close.

BioNxt Solutions Inc. (CSE:BNXT) (OTCQB:BNXTF) is still under the radar. But not for long.

The only question is whether you will do the work now, before the catalysts hit.

That is why we put together a detailed corporate presentation for investors who want to see everything for themselves.

Click here to download the corporate presentation and begin your due diligence today.