Silver has officially broken through $48, its highest level in more than 14 years.

This isn’t another short-lived spike. It’s structural.

Governments have declared silver a critical mineral.1 Tariffs are disrupting global supply. Demand from electric vehicles, solar panels, AI infrastructure, and defense systems is climbing to unprecedented levels.2

Yet while silver itself is running, the producers actually pulling ounces out of the ground have barely budged.

That’s the disconnect.

And at the center of it is First Majestic Silver Corp. (NYSE:AG) (TSX:AG), one of the only true pure-play silver producers with four active mines, over 30 million silver-equivalent ounces of annual production,3 and margins expanding with every tick higher in silver.

Despite reporting $285.1 million in quarterly revenue and $43.0 million in net earnings,4 the stock is still trading under $15.

For investors who understand how silver bull markets play out, this is the kind of setup that can lead to extraordinary gains.

Why Silver Is Suddenly in the Spotlight

The silver market has been quietly tightening for years, but now the squeeze is undeniable:

- Global mine supply peaked back in 2016. Exploration budgets have failed to replace reserves.

- The Silver Institute reported a 148.9-million-ounce deficit in 2024, the second-largest shortfall ever recorded.

- New US tariffs on Chinese metals have disrupted supply chains, forcing buyers to seek regional producers.5

- Washington formally declared silver a critical mineral, opening the door to subsidies, reserve stockpiling, and fast-track permitting.

Meanwhile, institutional capital is moving aggressively:

- Silver-backed ETFs absorbed 95 million ounces in the first half of 2025, pushing assets above $40 billion.6

- Sprott’s new Silver Miners & Physical ETF hit $100 million AUM at launch with First Majestic as its top holding.7

- Major banks including JPMorgan, Citi, and HSBC are raising silver price targets as the market realigns.8,9

Put simply, the demand is here. The supply is constrained. And silver producers like First Majestic Silver Corp. (NYSE:AG) (TSX:AG) are about to be revalued.

SUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.

Get investment opportunities before the rest of the market in real-time.

Get this company's corporate presentation now. Subscribe to download!

Over 120,000 subscribers

First Majestic Silver Corp. (NYSE:AG) (TSX:AG): A Producer Built for This Moment

While thousands of juniors are drilling for the next discovery, First Majestic Silver Corp. (NYSE:AG) (TSX:AG) is already delivering real results.

Here’s why it stands out:

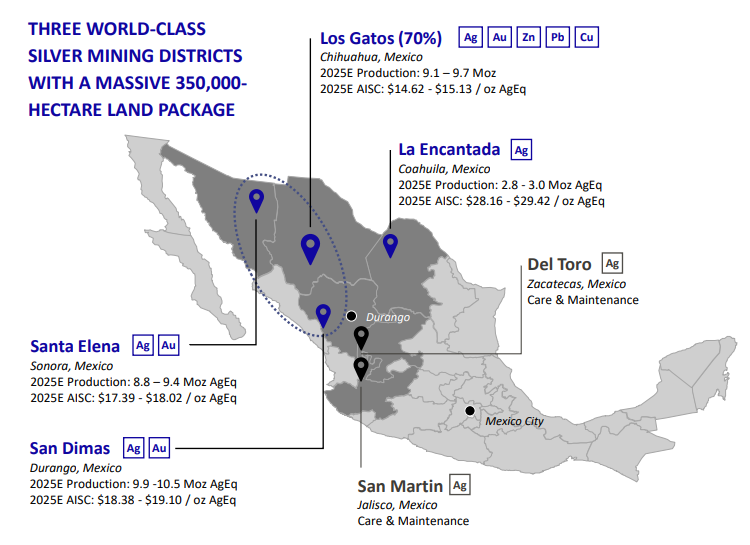

- Four operating mines in Mexico: San Dimas, Santa Elena, La Encantada, and Los Gatos

- 30–32 million silver-equivalent ounces projected for 2025 — production happening now, not years from now

- $285.1 million revenue and $43.0 million net earnings in Q2 2025 — one of the strongest quarters in company history

- Over 35,000 ounces of gold in Q3 — adding torque and lowering effective silver costs

- All-in sustaining costs under$21/oz with silver trading above $48 — a 48% margin and widening

- Zero near-term need for dilution — cash flow is funding growth

This isn’t a speculative story. It’s a proven silver machine operating in one of the tightest supply markets we’ve seen in decades.

Press Releases

- First Majestic Announces Positive Exploration Results at San Dimas

- First Majestic Announces Record Financial Results for Q2 2025 and Quarterly Dividend Payment

- First Majestic Second Quarter 2025 Results Conference Call Details

- First Majestic Produces 7.9 Million AgEq Ounces in Q2 2025 Consisting of 3.7 Million Silver Ounces and 33,865 Gold Ounces; Announces Improved 2025 Production and Cost Guidance and Conference Call Details

- First Majestic Announces Second Gold-Silver Discovery Within a Year at Santa Elena and Expands High-Grade Mineralization at Navidad

Technology That Expands Margins

What separates First Majestic Silver Corp. (NYSE:AG) (TSX:AG) isn’t just production scale, it’s efficiency.

At its Santa Elena mine, the company installed the industry’s first-ever High-Intensity Grinding (HIG) mill.

The results:

- Recovery rates boosted to as high as 94%

- More ounces pulled from every ton of ore

- Lower energy usage and stronger margins

In an industry where pennies per ounce make a difference, this proprietary technology is giving First Majestic a structural edge that no competitor has replicated.

The Los Gatos Game-Changer

In early 2025, First Majestic Silver Corp. (NYSE:AG) (TSX:AG) acquired 70% ownership of the Los Gatos mine, one of Mexico’s highest-grade silver operations.

This asset is expected to produce over 13 million silver-equivalent ounces this year alone.10

But the real upside lies in the surrounding 103,000-hectare land package. Much of it has never been drilled,11 and management believes the resource expansion potential is “significant.”

With Los Gatos, First Majestic has not only boosted current production but also secured a growth runway for years to come.

Leadership With Conviction

Behind the numbers is one of the most respected names in silver: Keith Neumeyer.

- Founded First Majestic Silver Corp. (NYSE:AG) (TSX:AG) and built it into one of the largest pure-play silver producers in the world

- Founded First Quantum Minerals and helped launch First Mining Gold

- Publicly called for triple-digit silver long before the current breakout

- Refuses to hedge silver production with every ounce is exposed to rising prices

Neumeyer’s conviction is baked into the company’s DNA. He’s not building for the short term. He’s positioning First Majestic to lead the next silver cycle.

The Valuation Gap That Can’t Last

Compare First Majestic Silver Corp. (NYSE:AG) (TSX:AG) to its closest peers and the disconnect is clear:

- Pan American Silver (NYSE:PAAS) has a market cap near $12 billion with flat production guidance.

- Hecla Mining (NYSE:HL) has a production profile similar to First Majestic and was once valued in the same range.

- First Majestic has a market cap around $4 billion with production growing and margins expanding.

Despite producing more silver-equivalent ounces than many peers, AG trades at a fraction of the valuation.

That’s the kind of asymmetry professional investors look for and it doesn’t stay hidden for long.

Institutions Are Already Quietly Buying

Even if the retail market hasn’t caught on, the smart money has.

Over 350 institutions now hold positions in First Majestic Silver Corp. (NYSE:AG) (TSX:AG), including:12

- VanEck International Investors — a major player in mining ETFs

- Sprott — with a reputation for spotting precious metals opportunities early

- Vanguard — showing broader institutional confidence

- JPMorgan — recently filed a new position

They’re not waiting for $50 silver. They’re building positions before the next move.

History Says the Biggest Moves Are Still Ahead

In 2011, silver climbed 175% in 18 months. Producers like First Majestic Silver Corp. (NYSE:AG) (TSX:AG) outperformed the metal itself.

In 1979, silver rocketed 700% in under a year. Again, it was the producers that captured the biggest gains.

Today’s setup is eerily similar, but with new catalysts: tariffs, critical mineral designations, and soaring industrial demand.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) has four producing mines, proprietary technology, high-grade discoveries, and a founder with a history of building billion-dollar companies.

And it’s still trading under $15.

Get the Full Story Before Wall Street Wakes Up

The window for mispricing silver producers doesn’t stay open long.

First Majestic Silver Corp. (NYSE:AG) (TSX:AG) is already generating hundreds of millions in revenue, reporting strong profits, and expanding production, yet the stock is priced like a junior.

That disconnect is the opportunity.

👉 Access the full report and corporate deck here.

Get investment opportunities before the rest of the market in real-time. Get this company's corporate presentation now. Subscribe to download! Over 120,000 subscribersSUBSCRIBE FOR TRADING INSIGHTS AND ALERTS. STAY AHEAD.